Question: could anyone give me a step by step solution, thank you! Consider the limit order book for Stock A Ask Volume Ask Price Bid Price

could anyone give me a step by step solution, thank you!

could anyone give me a step by step solution, thank you!

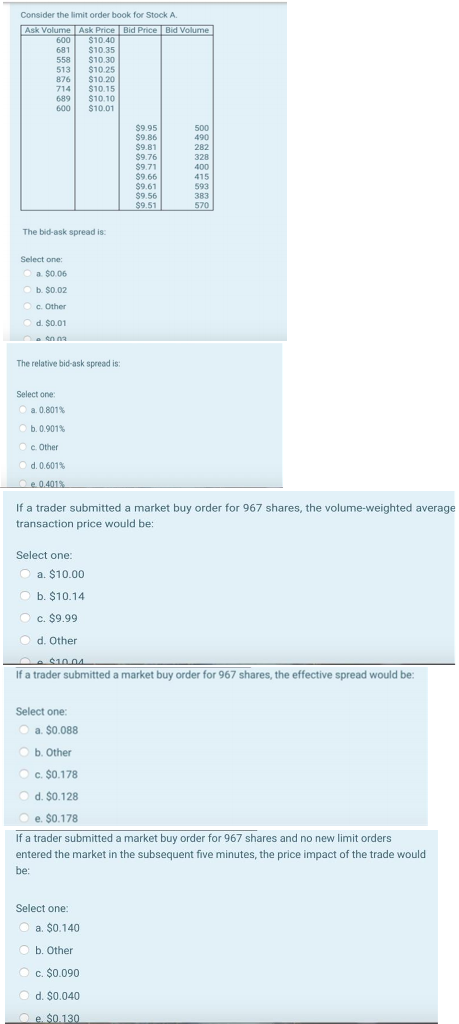

Consider the limit order book for Stock A Ask Volume Ask Price Bid Price Bid Volume 600 $10.40 681 $10.35 558 $10.30 513 $10.25 876 $10.20 714 $10.15 689 $10.10 600 $10.01 $9.95 $9.86 $9.81 $9.76 $9.71 $9.66 $9.61 $9.56 $9.51 500 490 282 328 400 415 593 383 570 The bid-ask spread is Select one: a $0.06 b. $0.02 c. Other d. $0.01 ca The relative bid-ask spread is Select one a. 0.801% b.0.901% c. Other @d. 0.601% e 04019 If a trader submitted a market buy order for 967 shares, the volume-weighted average transaction price would be: Select one: a. $10.00 b. $10.14 c. $9.99 d. Other A $10.04 If a trader submitted a market buy order for 967 shares, the effective spread would be: Select one: a. $0.088 b. Other c. $0.178 d. $0.128 e. $0.178 e. If a trader submitted a market buy order for 967 shares and no new limit orders a entered the market in the subsequent five minutes, the price impact of the trade would be: Select one: . a $0.140 b. Other c. $0.090 d. S0.040 e $0.1130

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts