Question: Consider the March 2010 $5 put option on JetBlue, maturing on March 19, 2010, listed in Table B. Assume that the volatility of JetBlue is

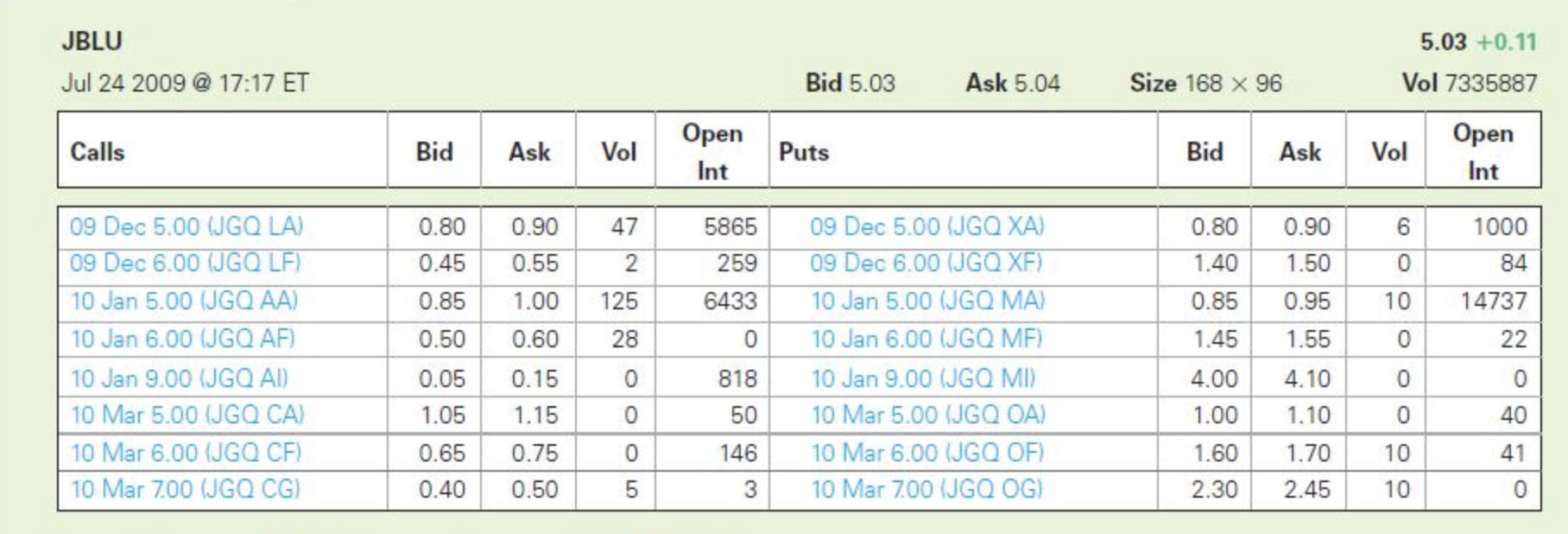

Consider the March 2010 $5 put option on JetBlue, maturing on March 19, 2010, listed in Table B. Assume that the volatility of JetBlue is 67.4% per year and its beta is 0.82. The short-term risk-free rate of interest is 2.48% per year. a. What is the beta of the put option? b. What is the put option's leverage ratio? c. If the expected risk premium of the market is 6%, what is the expected return of the put option based on the CAPM? d. Given its expected return, why would an investor buy a put option? Use a 365-day year. JBLU Jul 24 2009 @ 17:17 ET 5.03 +0.11 Vol 7335887 Bid 5.03 Ask 5.04 Size 168 x 96 Calls Bid Ask Vol Open Int Puts Bid Ask Vol Open Int 1000 84 14737 22 09 Dec 5.00 (JGQ LA) 09 Dec 6.00 (JGQ LF) 10 Jan 5.00 (JGO AA) 10 Jan 6.00 (JGQ AF) 10 Jan 9.00 (JGO AI 10 Mar 5.00 (JGQ CA) 10 Mar 6.00 (JGQ CF) 10 Mar 700 (JGQ CG) 0.80 0.45 0.85 0.50 0.05 1.05 0.65 0.40 0.90 0.55 1.00 0.60 0.15 1.15 0.75 0.50 47 2 125 28 0 0 0 5 5865 259 6433 0 818 50 146 3 09 Dec 5.00 (JGO XA) 09 Dec 6.00 (JGQ XF) 10 Jan 5.00 (JGQ MA 10 Jan 6.00 (JGQ MF) 10 Jan 9.00 (JGO MI) 10 Mar 5.00 (JGQ OA) 10 Mar 6.00 (JGQ OF) 10 Mar 700 (JGQ OG) 0.80 1.40 0.85 1.45 4.00 1.00 1.60 2.30 0.90 1.50 0.95 1.55 4.10 1.10 1.70 2.45 6 0 10 0 0 0 10 10 0 40 41 0 Consider the March 2010 $5 put option on JetBlue, maturing on March 19, 2010, listed in Table B. Assume that the volatility of JetBlue is 67.4% per year and its beta is 0.82. The short-term risk-free rate of interest is 2.48% per year. a. What is the beta of the put option? b. What is the put option's leverage ratio? c. If the expected risk premium of the market is 6%, what is the expected return of the put option based on the CAPM? d. Given its expected return, why would an investor buy a put option? Use a 365-day year. JBLU Jul 24 2009 @ 17:17 ET 5.03 +0.11 Vol 7335887 Bid 5.03 Ask 5.04 Size 168 x 96 Calls Bid Ask Vol Open Int Puts Bid Ask Vol Open Int 1000 84 14737 22 09 Dec 5.00 (JGQ LA) 09 Dec 6.00 (JGQ LF) 10 Jan 5.00 (JGO AA) 10 Jan 6.00 (JGQ AF) 10 Jan 9.00 (JGO AI 10 Mar 5.00 (JGQ CA) 10 Mar 6.00 (JGQ CF) 10 Mar 700 (JGQ CG) 0.80 0.45 0.85 0.50 0.05 1.05 0.65 0.40 0.90 0.55 1.00 0.60 0.15 1.15 0.75 0.50 47 2 125 28 0 0 0 5 5865 259 6433 0 818 50 146 3 09 Dec 5.00 (JGO XA) 09 Dec 6.00 (JGQ XF) 10 Jan 5.00 (JGQ MA 10 Jan 6.00 (JGQ MF) 10 Jan 9.00 (JGO MI) 10 Mar 5.00 (JGQ OA) 10 Mar 6.00 (JGQ OF) 10 Mar 700 (JGQ OG) 0.80 1.40 0.85 1.45 4.00 1.00 1.60 2.30 0.90 1.50 0.95 1.55 4.10 1.10 1.70 2.45 6 0 10 0 0 0 10 10 0 40 41 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts