Question: Consider the methods we've learned for capital budgeting: making decisions about what investments to make or projects to accept. We know that all three of

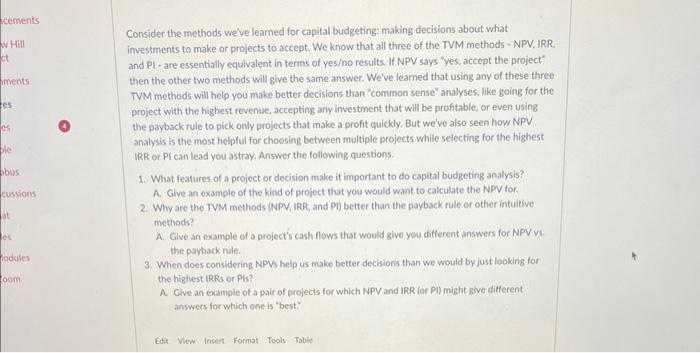

Consider the methods we've learned for capital budgeting: making decisions about what investments to make or projects to accept. We know that all three of the TVM methods - NPV. IRR. and PI - are essentially equivalent in terms of yeso results. If NPV says "yes, accept the project" then the other two methods will give the same answer. We've learned that using any of these three TVM methods will help you make better decisions than "common sense' analyses. llike going for the project with the highest revenue, accepting any investment that will be profitable, or even using the payback rule to pick only projects that make a profit quickly. But we ve also seen how NPV analysis is the most helpful for choosing between multiple projects while selecting for the highest IRR or Pl can lead you astray. Answer the following questions. 1. What features of a project or decision make it important to do capital budgeting analysis? A. Give an example of the kind of project that you would want to calculate the NPV for: 2. Why are the TVM methods (NPV, IRR, and PI) better than the payback rule or other intuitive methods? A. Give an example of a project's cash flows that would give you different answers for NPV vs. the payback rule. 3. When does considering NPVs help us make better decisions than we would by just looking for the highest IRRs or Pls? A. Give an example of a pair of projects for which NPV and IRR (or PI) might give different answers for which one is "best:" Edit View tessert Format Tools Table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts