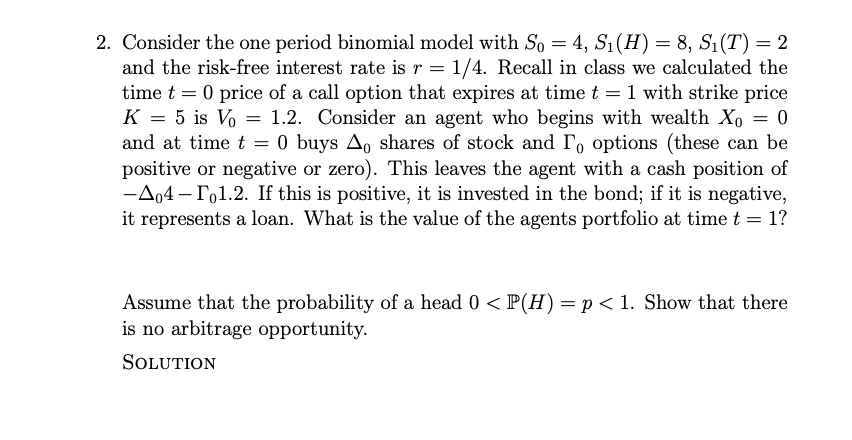

Question: Consider the one period binomial model with S 0 = 4 , S 1 ( H ) = 8 , S 1 ( T )

Consider the one period binomial model with

and the riskfree interest rate is Recall in class we calculated the

time price of a call option that expires at time with strike price

is Consider an agent who begins with wealth

and at time buys shares of stock and options these can be

positive or negative or zero This leaves the agent with a cash position of

If this is positive, it is invested in the bond; if it is negative,

it represents a loan. What is the value of the agents portfolio at time

Assume that the probability of a head Show that there

arbitrage opportunity.

Solution JUST FIGURE OUT WHAT THE VALUE OF THE AGENTS PORTFOLIO IS AT T

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock