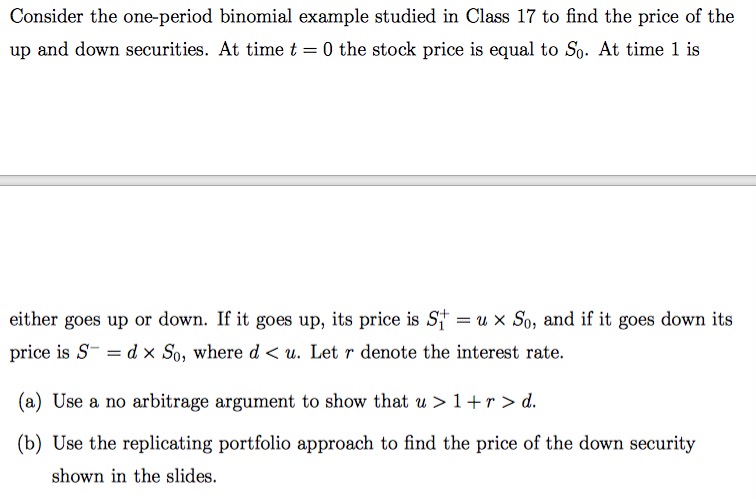

Question: Consider the one-period binomial example studied in Class 17 to find the price of the up and down securities. At time t=0 the stock

Consider the one-period binomial example studied in Class 17 to find the price of the up and down securities. At time t=0 the stock price is equal to So. At time 1 is either goes up or down. If it goes up, its price is St=ux So, and if it goes down its price is S d x So, where d < u. Let r denote the interest rate. = (a) Use a no arbitrage argument to show that u > 1+r> d. (b) Use the replicating portfolio approach to find the price of the down security shown in the slides.

Step by Step Solution

There are 3 Steps involved in it

a Assume u 1r Consider a portfolio that is long in one unit of the down security at price SdS and sh... View full answer

Get step-by-step solutions from verified subject matter experts