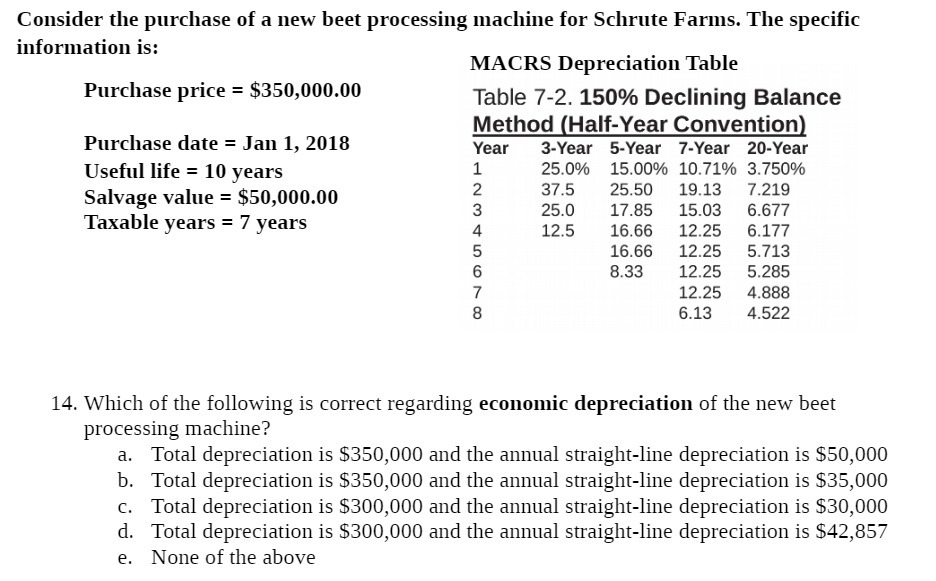

Question: Consider the purchase of a new beet processing machine for Schrute Farms. The specific information is: MACRS Depreciation Table Purchase price = $350,000.00 Table 7-2.

Consider the purchase of a new beet processing machine for Schrute Farms. The specific information is: MACRS Depreciation Table Purchase price = $350,000.00 Table 7-2. 150% Declining Balance Purchase date = Jan 1, 2018 Method (Half-Year Convention) Year 3-Year 5-Year 7-Year 20-Year Useful life = 10 years 25.0% 15.00% 10.71% 3.750% Salvage value = $50,000.00 37.5 25.50 19.13 7.219 Taxable years = 7 years DO YOUAWNG 25.0 17.85 15.03 6.677 12.5 16.66 12.25 6.177 16.66 12.25 5.713 8.33 12.25 5.285 12.25 4.888 6.13 4.522 14. Which of the following is correct regarding economic depreciation of the new beet processing machine? a. Total depreciation is $350,000 and the annual straight-line depreciation is $50,000 b. Total depreciation is $350,000 and the annual straight-line depreciation is $35,000 c. Total depreciation is $300,000 and the annual straight-line depreciation is $30,000 d. Total depreciation is $300,000 and the annual straight-line depreciation is $42,857 e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts