Question: Consider the purchase of a new beet processing machine for Schrute Farms. The specific information is: Purchase price = $350,000.00 Purchase date = Jan

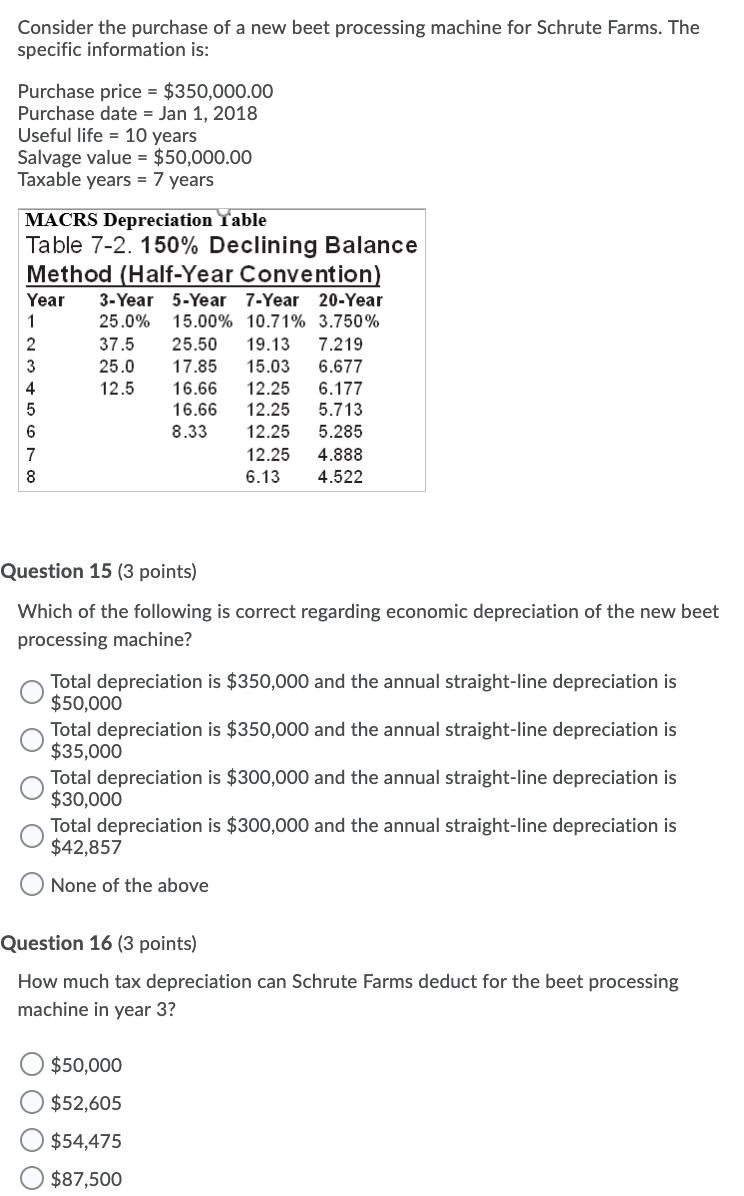

Consider the purchase of a new beet processing machine for Schrute Farms. The specific information is: Purchase price = $350,000.00 Purchase date = Jan 1, 2018 Useful life = 10 years Salvage value = $50,000.00 Taxable years = 7 years MACRS Depreciation Table Table 7-2. 150% Declining Balance Method (Half-Year Convention) Year 3-Year 5-Year 7-Year 20-Year 1 25.0% 2 37.5 15.00% 10.71% 3.750% 25.50 19.13 7.219 3 25.0 17.85 15.03 6.677 4 12.5 16.66 12.25 6.177 5 16.66 12.25 5.713 6 8.33 12.25 5.285 7 12.25 4.888 8 6.13 4.522 Question 15 (3 points) Which of the following is correct regarding economic depreciation of the new beet processing machine? Total depreciation is $350,000 and the annual straight-line depreciation is $50,000 Total depreciation is $350,000 and the annual straight-line depreciation is $35,000 Total depreciation is $300,000 and the annual straight-line depreciation is $30,000 Total depreciation is $300,000 and the annual straight-line depreciation is $42,857 None of the above Question 16 (3 points) How much tax depreciation can Schrute Farms deduct for the beet processing machine in year 3? $50,000 $52,605 $54,475 $87,500 Question 17 (3 points) What is the salvage value of the beet machine at the end of year 1 if 150% declining balance is used for economic depreciation? $37,485 $52,500 $297,500 $312,515

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Book1 Microsoft Excel AutoSum Number Conditional Format Formatting as Table Styles Styles Cell I... View full answer

Get step-by-step solutions from verified subject matter experts