Question: consider the rivalry between Boeing and Airbus t o develop a new commercial jet aircraft. Suppose Boeing i s ahead i n the development process,

consider the rivalry between Boeing and Airbus develop a new commercial jet aircraft. Suppose Boeing ahead the development process, and Airbus considering whether enter the competition. Airbus stays out, earns a profit $ whereas Boeing enjoys a monopoly and earns a profit $ billion. Airbus decides enter and develop a rival airplane, then Boeing has decide whether accommodate Airbus peaceably wage a price war. the event peaceful competition, each firm will make a profit $ million. there a price war, each will lose $ million because the prices airplanes will fall low that neither firm will able recoup its development costs. Using the subgame perfect Nash equilibrium concept, what will the outcome this game?

Airbus will enter and Boeing will wage a price war.

Airbus will enter and Boeing will accommodate peaceably.

Not enough information.

Airbus will not enter.

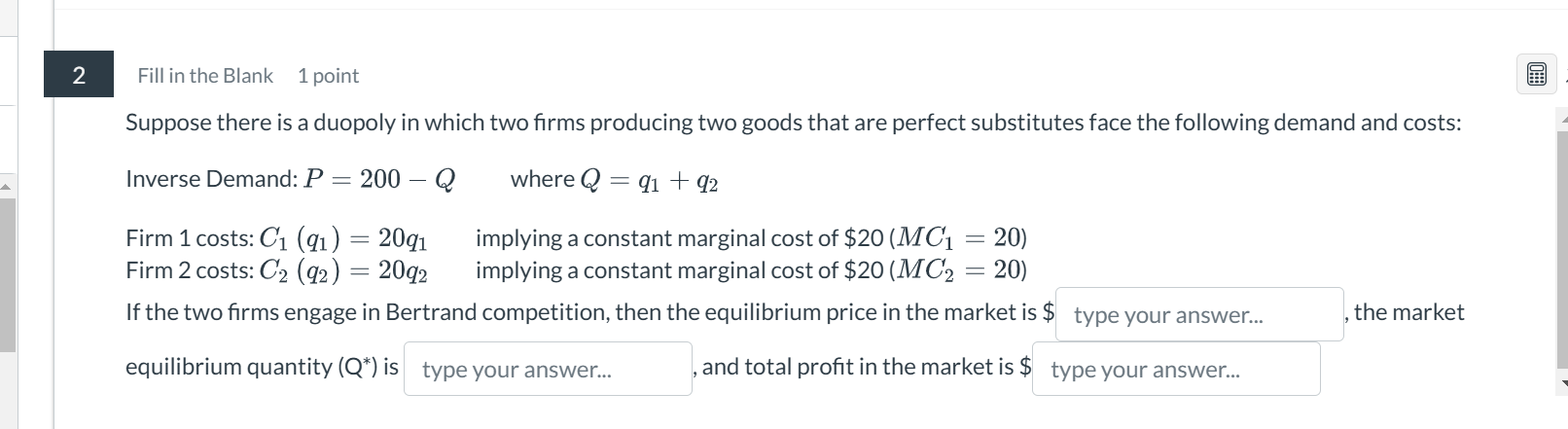

Suppose there a duopoly which two firms producing two goods that are perfect substitutes face the following demand and costs:

Inverse Demand: where

Firm costs: implying a constant marginal cost $

Firm costs: implying a constant marginal cost $

the two firms engage Bertrand competition, then the equilibrium price the market :

the market

equilibrium quantity

and total profit the market $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock