Question: Consider the Rothschild-Stiglitz Model. In this example, we will examine the case of asymmetric insurance and heterogenous risk types. The utility function (for each consumer)

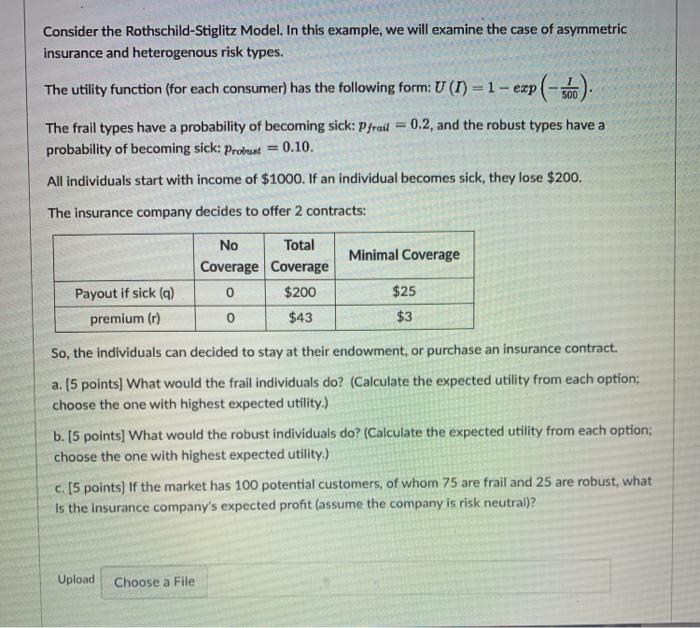

Consider the Rothschild-Stiglitz Model. In this example, we will examine the case of asymmetric insurance and heterogenous risk types. The utility function (for each consumer) has the following form: U (1) = 1 exp(-50 The frail types have a probability of becoming sick: Pfrail 0.2, and the robust types have a probability of becoming sick: Probust = 0.10. All individuals start with income of $1000. If an individual becomes sick, they lose $200. The insurance company decides to offer 2 contracts: Minimal Coverage No Total Coverage Coverage 0 $200 $43 Payout if sick (q) premium (r) $25 $3 So, the individuals can decided to stay at their endowment, or purchase an insurance contract. a. (5 points) What would the frail individuals do? (Calculate the expected utility from each option; choose the one with highest expected utility.) b. [5 points) What would the robust individuals do? (Calculate the expected utility from each option: choose the one with highest expected utility.) c. [5 points) If the market has 100 potential customers, of whom 75 are frail and 25 are robust, what is the insurance company's expected profit (assume the company is risk neutral)? Upload Choose a File Consider the Rothschild-Stiglitz Model. In this example, we will examine the case of asymmetric insurance and heterogenous risk types. The utility function (for each consumer) has the following form: U (1) = 1 exp(-50 The frail types have a probability of becoming sick: Pfrail 0.2, and the robust types have a probability of becoming sick: Probust = 0.10. All individuals start with income of $1000. If an individual becomes sick, they lose $200. The insurance company decides to offer 2 contracts: Minimal Coverage No Total Coverage Coverage 0 $200 $43 Payout if sick (q) premium (r) $25 $3 So, the individuals can decided to stay at their endowment, or purchase an insurance contract. a. (5 points) What would the frail individuals do? (Calculate the expected utility from each option; choose the one with highest expected utility.) b. [5 points) What would the robust individuals do? (Calculate the expected utility from each option: choose the one with highest expected utility.) c. [5 points) If the market has 100 potential customers, of whom 75 are frail and 25 are robust, what is the insurance company's expected profit (assume the company is risk neutral)? Upload Choose a File

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts