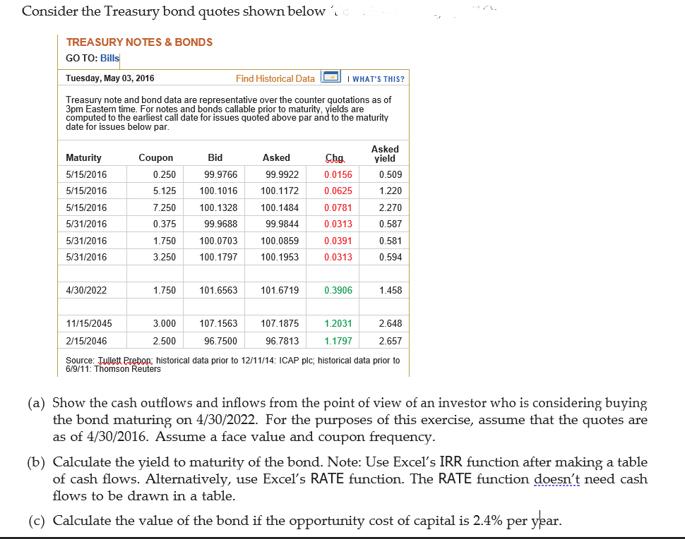

Question: Consider the Treasury bond quotes shown below. TREASURY NOTES & BONDS GO TO: Bills Tuesday, May 03, 2016 Find Historical Data Treasury note and

Consider the Treasury bond quotes shown below. TREASURY NOTES & BONDS GO TO: Bills Tuesday, May 03, 2016 Find Historical Data Treasury note and bond data are representative over the counter quotations as of 3pm Eastern time. For notes and bonds callable prior to maturity, yields are computed to the earliest call date for issues quoted above par and to the maturity date for issues below par. Maturity 5/15/2016 5/15/2016 5/15/2016 5/31/2016 5/31/2016 5/31/2016 4/30/2022 11/15/2045 2/15/2046 Bid 0.250 99.9766 99.9922 5.125 100.1016 100.1172 7.250 100.1328 100.1484 0.375 99.9688 99.9844 1.750 100.0703 3.250 100.1797 Coupon 1.750 101.6563 Asked 3.000 107.1563 2.500 96.7500 100,0859 100.1953 101.6719 I WHAT'S THIS? Cho 0.0156 0.509 0.0625 1.220 0.0781 2.270 0.0313 0.587 0.0391 0.0313 Asked yield 0.3906 0.581 0.594 1.458 107.1875 1.2031 2.648 96.7813 1.1797 2.657 Source: Tullett Prebon historical data prior to 12/11/14: ICAP plc; historical data prior to 6/9/11: Thomson Reuters (a) Show the cash outflows and inflows from the point of view of an investor who is considering buying the bond maturing on 4/30/2022. For the purposes of this exercise, assume that the quotes are as of 4/30/2016. Assume a face value and coupon frequency. (b) Calculate the yield to maturity of the bond. Note: Use Excel's IRR function after making a table of cash flows. Alternatively, use Excel's RATE function. The RATE function doesn't need cash flows to be drawn in a table. (c) Calculate the value of the bond if the opportunity cost of capital is 2.4% per year.

Step by Step Solution

There are 3 Steps involved in it

Here are the answers to the questions a Cash outflows and ... View full answer

Get step-by-step solutions from verified subject matter experts