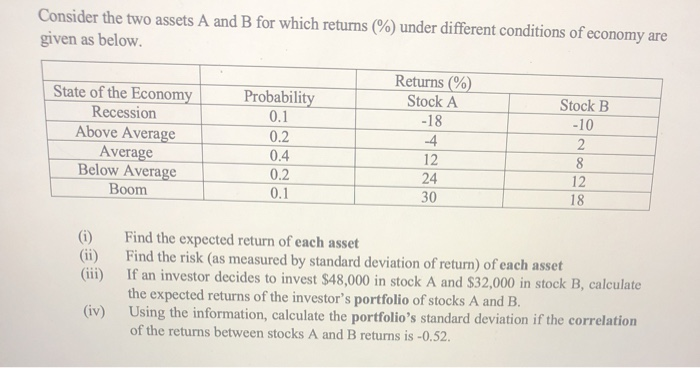

Question: Consider the two assets A and B for which returns (%) under different conditions of economy are given as below. Returns (%) State of the

Consider the two assets A and B for which returns (%) under different conditions of economy are given as below. Returns (%) State of the Economy Probability Stock A Stock B Recession 0.1 -18 -10 Above Average 0.2 -4 2 Average 0.4 12 8 Below Average 0.2 24 12 Boom 0.1 30 18 (i) (iii) Find the expected return of each asset Find the risk (as measured by standard deviation of return) of each asset If an investor decides to invest $48,000 in stock A and $32,000 in stock B, calculate the expected returns of the investor's portfolio of stocks A and B. Using the information, calculate the portfolio's standard deviation if the correlation of the returns between stocks A and B returns is -0.52. (iv)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts