Question: Consider the two ( excess return ) index - model regression results for stocks A and B . The riskfree rate over the period was

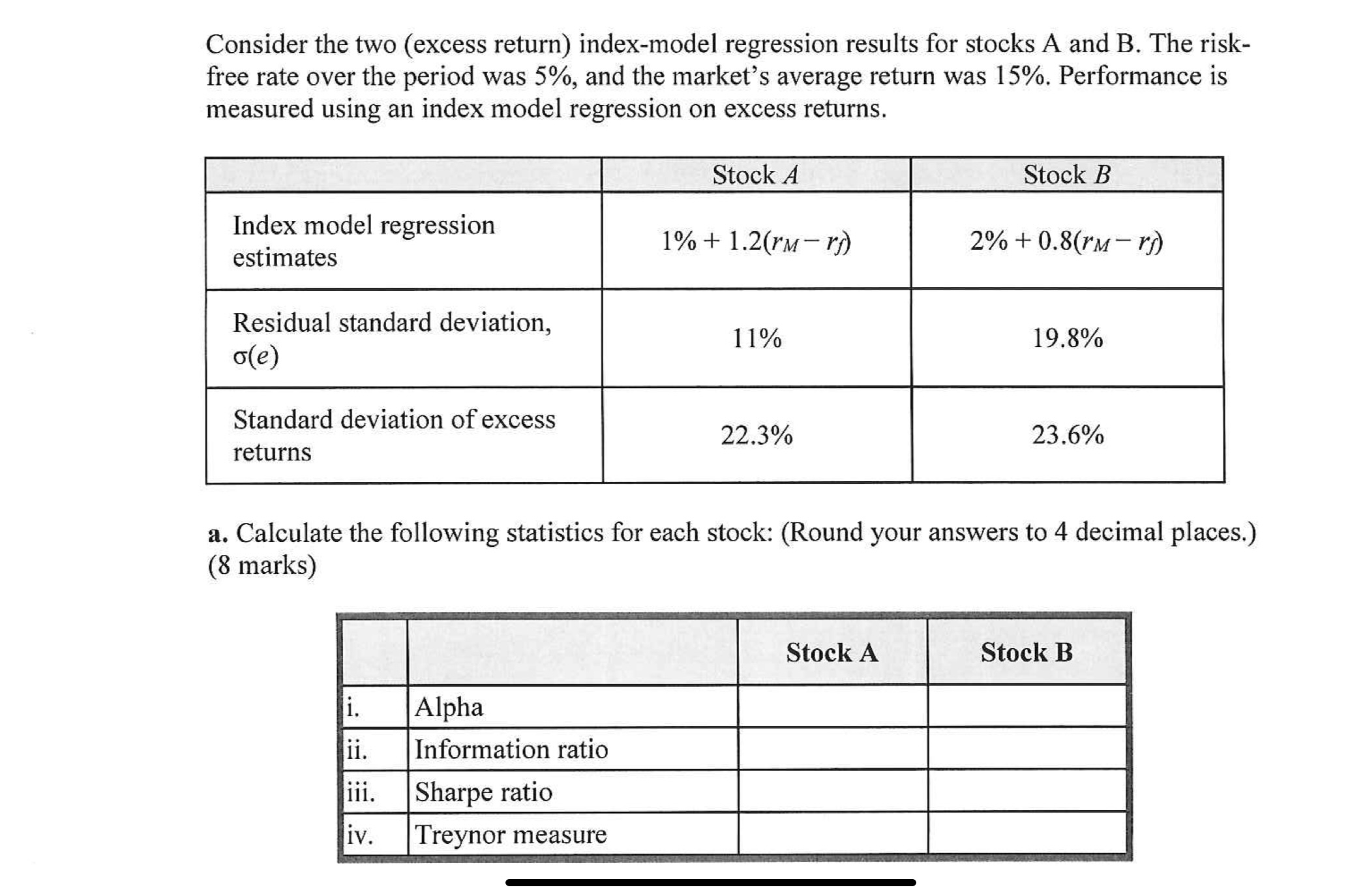

Consider the two excess return indexmodel regression results for stocks A and B The riskfree rate over the period was and the market's average return was Performance is measured using an index model regression on excess returns.

tableStock AStock BtableIndex model regressionestimatesrMrfrMrftableResidual standard deviation,sigma etableStandard deviation of excessreturns

a Calculate the following statistics for each stock: Round your answers to decimal places. marks

tableStock AStock BiAlpha,,iiInformation ratio,,iiiSharpe ratio,,ivTreynor measure,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock