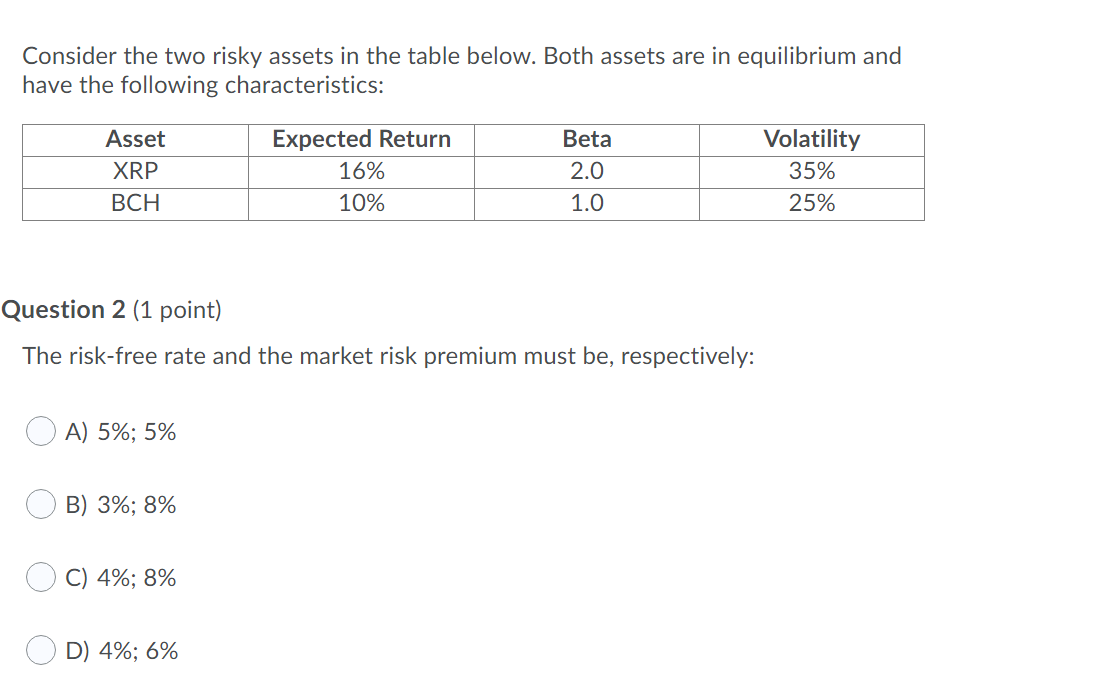

Question: Consider the two risky assets in the table below. Both assets are in equilibrium and have the following characteristics: Asset XRP BCH Expected Return 16%

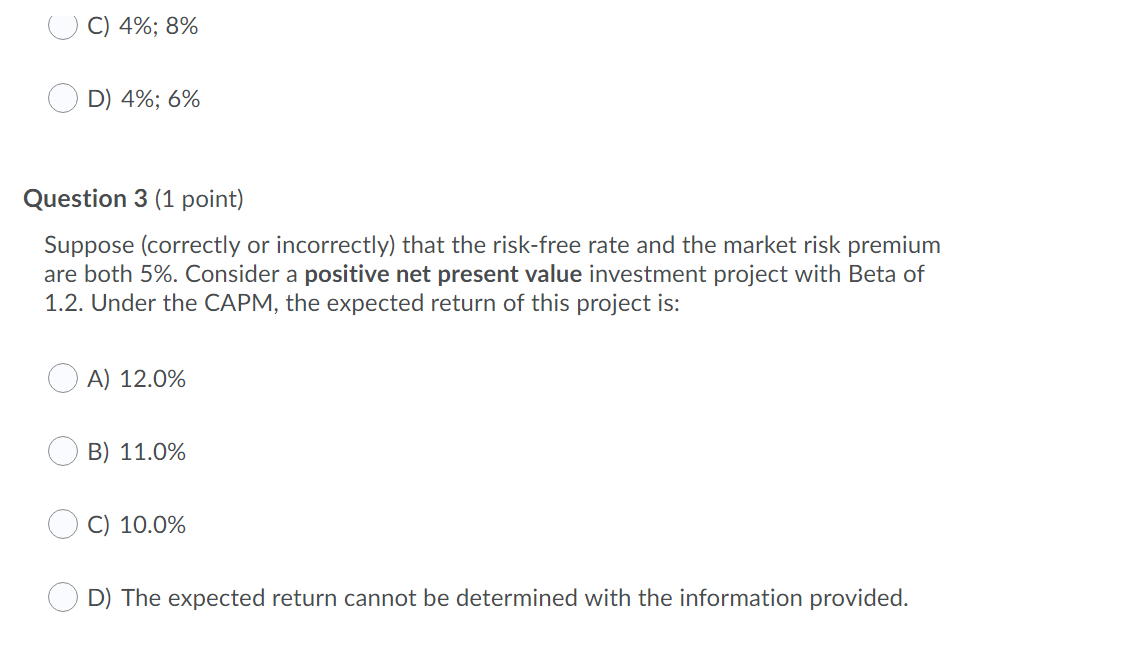

Consider the two risky assets in the table below. Both assets are in equilibrium and have the following characteristics: Asset XRP BCH Expected Return 16% 10% Beta 2.0 1.0 Volatility 35% 25% Question 2 (1 point) The risk-free rate and the market risk premium must be, respectively: OA) 5%; 5% OB) 3%; 8% O C) 4%; 8% OD) 4%; 6% UC) 4%; 8% OD) 4%; 6% Question 3 (1 point) Suppose (correctly or incorrectly) that the risk-free rate and the market risk premium are both 5%. Consider a positive net present value investment project with Beta of 1.2. Under the CAPM, the expected return of this project is: OA) 12.0% B) 11.0% 0 C) 10.0% O D) The expected return cannot be determined with the information provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts