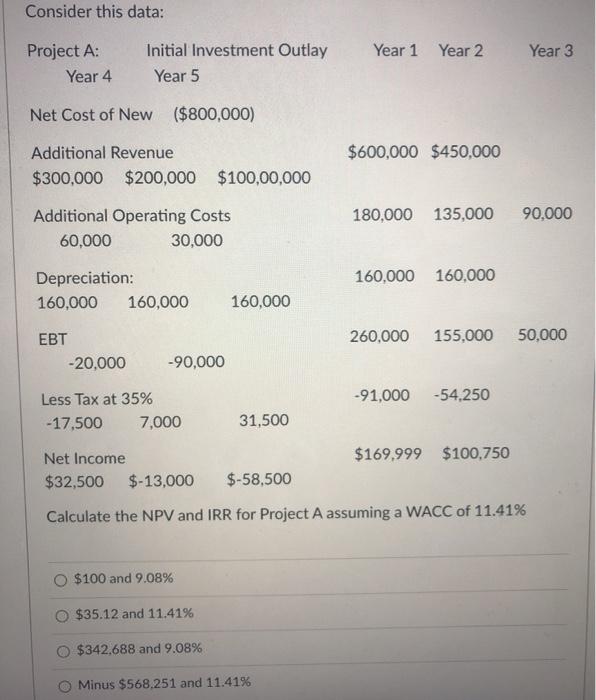

Question: Consider this data: Year 1 Year 2 Year 3 Project A: Year 4 Initial Investment Outlay Year 5 Net Cost of New ($800,000) $600,000 $450,000

Consider this data: Year 1 Year 2 Year 3 Project A: Year 4 Initial Investment Outlay Year 5 Net Cost of New ($800,000) $600,000 $450,000 Additional Revenue $300,000 $200,000 $100,00,000 180,000 135,000 90,000 Additional Operating Costs 60,000 30,000 160,000 160,000 Depreciation: 160,000 160,000 160,000 260,000 155,000 50,000 EBT -20,000 -90,000 -91,000 -54,250 Less Tax at 35% -17,500 7,000 31,500 $169,999 $100,750 Net Income $32,500 $-13,000 $-58,500 Calculate the NPV and IRR for Project A assuming a WACC of 11.41% $100 and 9.08% $35.12 and 11.41% $342,688 and 9.08% Minus $568,251 and 11.41%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock