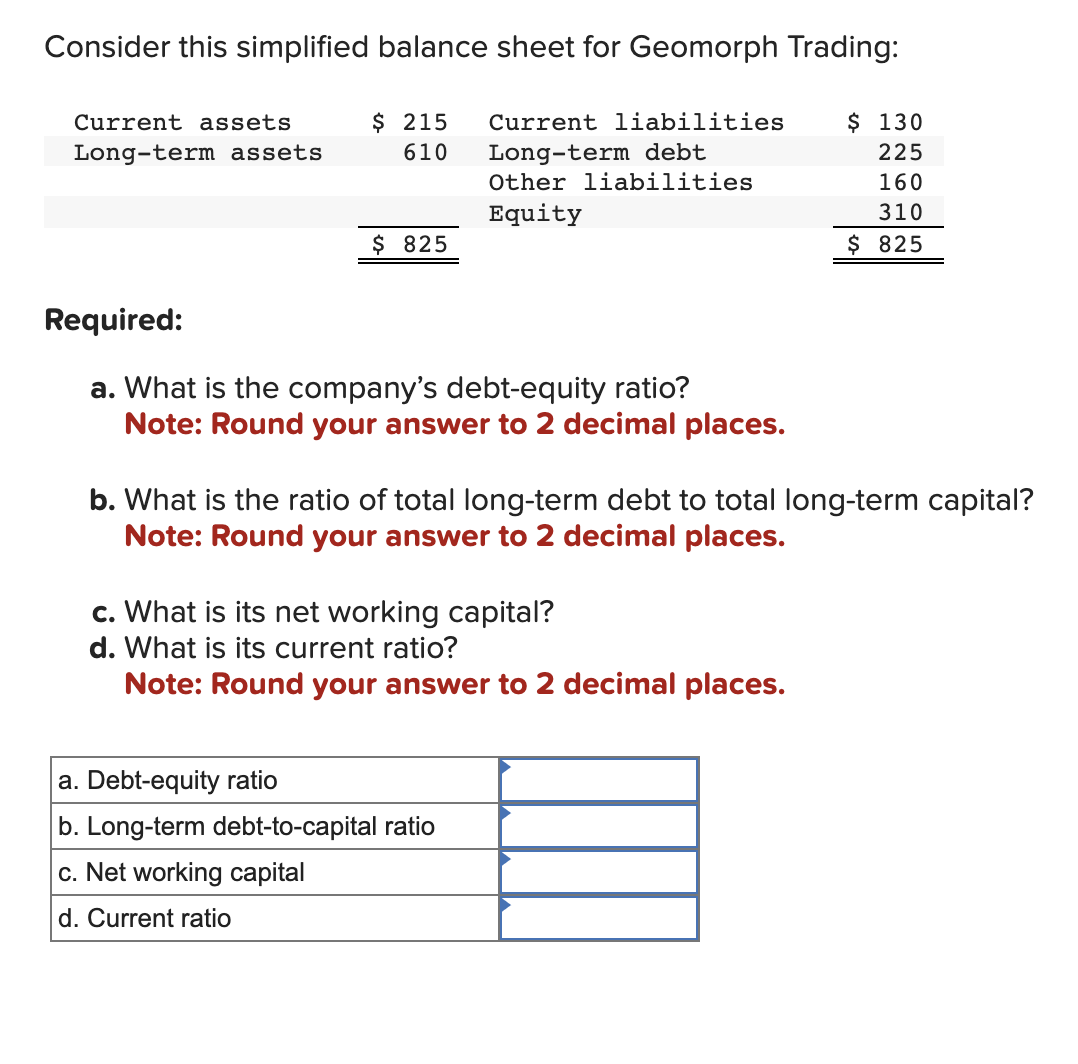

Question: Consider this simplified balance sheet for Geomorph Trading: Current liabilities Long-term debt Other liabilities Equity Current assets. Long-term assets. $ 215 610 $ 825

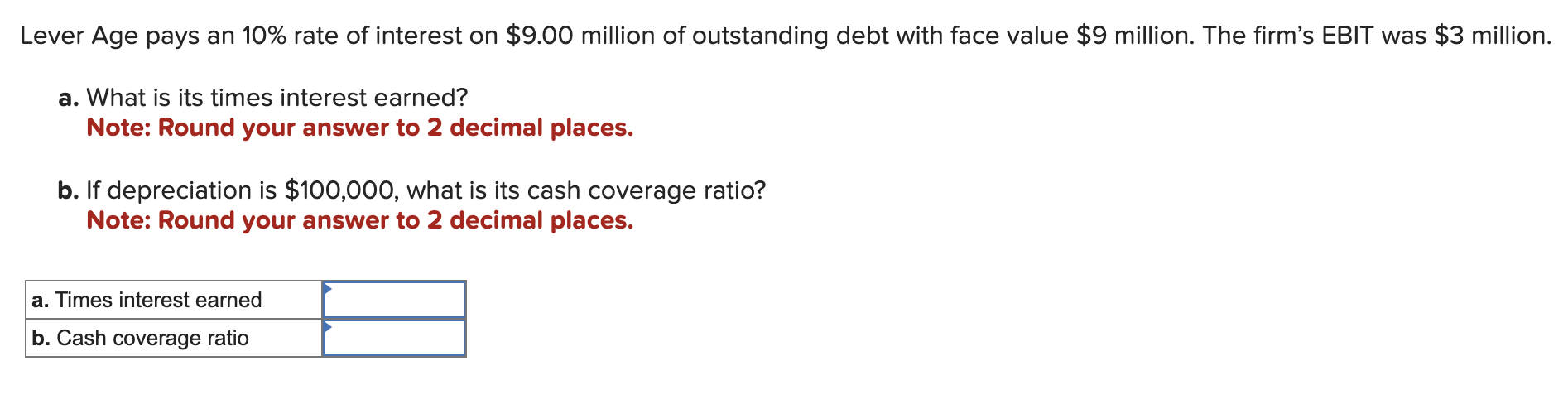

Consider this simplified balance sheet for Geomorph Trading: Current liabilities Long-term debt Other liabilities Equity Current assets. Long-term assets. $ 215 610 $ 825 Required: a. What is the company's debt-equity ratio? Note: Round your answer to 2 decimal places. b. What is the ratio of total long-term debt to total long-term capital? Note: Round your answer to 2 decimal places. c. What is its net working capital? d. What is its current ratio? Note: Round your answer to 2 decimal places. $ 130 225 160 310 $ 825 a. Debt-equity ratio b. Long-term debt-to-capital ratio c. Net working capital d. Current ratio Lever Age pays an 10% rate of interest on $9.00 million of outstanding debt with face value $9 million. The firm's EBIT was $3 million. a. What is its times interest earned? Note: Round your answer to 2 decimal places. b. If depreciation is $100,000, what is its cash coverage ratio? Note: Round your answer to 2 decimal places. a. Times interest earned b. Cash coverage ratio

Step by Step Solution

There are 3 Steps involved in it

a The companys debtequity ratio can be calculated by dividing the total debt by the equity De... View full answer

Get step-by-step solutions from verified subject matter experts