Question: . Consider three assets: Cornico stocks (C), Bertico stocks (B), and a risk-free asset such as Treasury bills. You observe that last year, the market

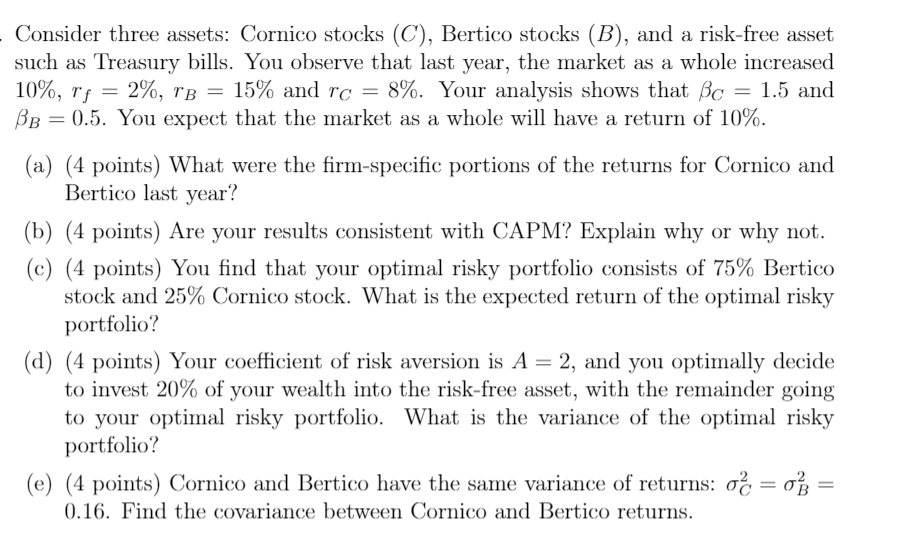

. Consider three assets: Cornico stocks (C), Bertico stocks (B), and a risk-free asset such as Treasury bills. You observe that last year, the market as a whole increased 10%, rs = 2%, rb = 15% and rc = 8%. Your analysis shows that Bc = 1.5 and BB = 0.5. You expect that the market as a whole will have a return of 10%. (a) (4 points) What were the firm-specific portions of the returns for Cornico and Bertico last year? (b) (4 points) Are your results consistent with CAPM? Explain why or why not. (c) (4 points) You find that your optimal risky portfolio consists of 75% Bertico stock and 25% Cornico stock. What is the expected return of the optimal risky portfolio? (d) (4 points) Your coefficient of risk aversion is A = 2, and you optimally decide to invest 20% of your wealth into the risk-free asset, with the remainder going to your optimal risky portfolio. What is the variance of the optimal risky portfolio? (e) (4 points) Cornico and Bertico have the same variance of returns: o = o3 = 0.16. Find the covariance between Cornico and Bertico returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts