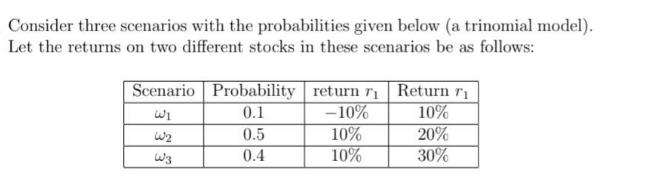

Question: Consider three scenarios with the probabilities given below (a trinomial model). Let the returns on two different stocks in these scenarios be as follows:

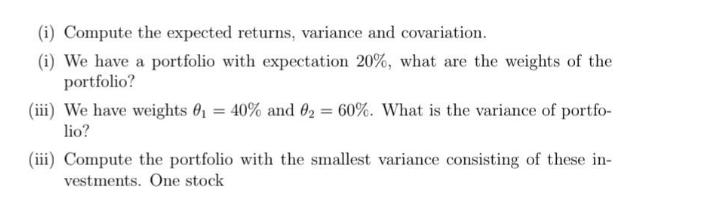

Consider three scenarios with the probabilities given below (a trinomial model). Let the returns on two different stocks in these scenarios be as follows: Scenario W3 Probability 0.1 0.5 0.4 return 71 Return ri -10% 10% 10% 20% 10% 30% (i) Compute the expected returns, variance and covariation. (i) We have a portfolio with expectation 20%, what are the weights of the portfolio? (iii) We have weights 0 = 40% and 02 = 60%. What is the variance of portfo- lio? (iii) Compute the portfolio with the smallest variance consisting of these in- vestments. One stock

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

SOLUTION i Compute the expected returns variance and covariation R... View full answer

Get step-by-step solutions from verified subject matter experts