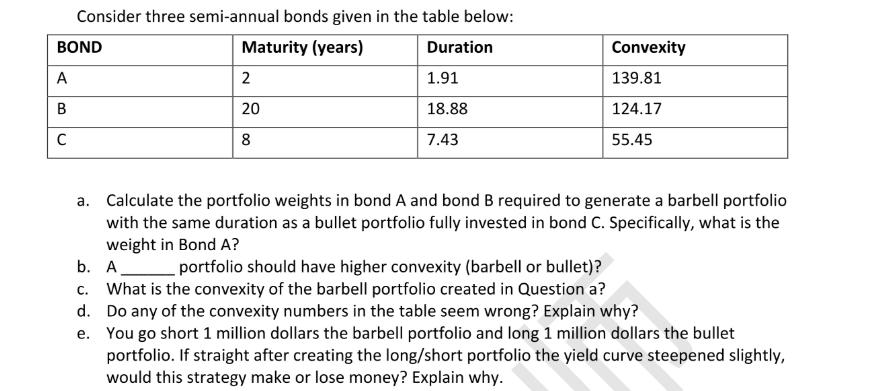

Question: Consider three semi-annual bonds given in the table below: Maturity (years) Duration 1.91 18.88 7.43 BOND A B C 2 20 8 Convexity 139.81

Consider three semi-annual bonds given in the table below: Maturity (years) Duration 1.91 18.88 7.43 BOND A B C 2 20 8 Convexity 139.81 124.17 55.45 a. Calculate the portfolio weights in bond A and bond B required to generate a barbell portfolio with the same duration as a bullet portfolio fully invested in bond C. Specifically, what is the weight in Bond A? b. A_______ portfolio should have higher convexity (barbell or bullet)? c. What is the convexity of the barbell portfolio created in Question a? d. Do any of the convexity numbers in the table seem wrong? Explain why? e. You go short 1 million dollars the barbell portfolio and long 1 million dollars the bullet portfolio. If straight after creating the long/short portfolio the yield curve steepened slightly, would this strategy make or lose money? Explain why.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Solution a To create a barbell portfolio with the same duration as a bullet portfolio fully invested ... View full answer

Get step-by-step solutions from verified subject matter experts