Question: Consider two 7 per cent $100 government bonds that differ only in date of maturity. One matures in 2 years and the other matures

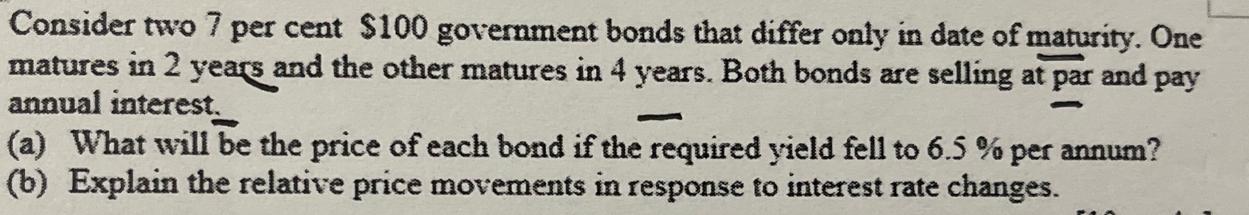

Consider two 7 per cent $100 government bonds that differ only in date of maturity. One matures in 2 years and the other matures in 4 years. Both bonds are selling at par and pay annual interest. (a) What will be the price of each bond if the required yield fell to 6.5 % per annum? (b) Explain the relative price movements in response to interest rate changes. TO

Step by Step Solution

3.55 Rating (166 Votes )

There are 3 Steps involved in it

To calculate the price of each bond under different yield scenarios we can use the present value for... View full answer

Get step-by-step solutions from verified subject matter experts