Question: Consider two alternative tax systems. System 1 has a standard deduction for every household equal to $5,000, and a constant marginal tax rate of.10 on

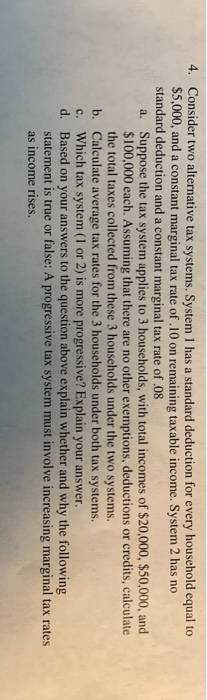

Consider two alternative tax systems. System 1 has a standard deduction for every household equal to $5,000, and a constant marginal tax rate of.10 on remaining taxable income. System 2 has no standard deduction and a constant marginal tax rate of .08 4. Suppose the tax system applies to 3 households, with total incomes of $20,000, $50,000, and $100,000 each. Assuming that there are no other exemptions, deductions or credits, calculate the total taxes collected from these 3 households under the two systems. Calculate average tax rates for the 3 households under both tax systems. Which tax system (1 or 2) is more progressive? Explain your answer Based on your answers to the question above explain whether and why the following statement is true or false: A progressive tax system must involve increasing marginal tax rates a. b. c. d. 1 as income rises

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts