Question: Consider two bonds A and B with payments Ct, where t = 1,2, ...,10. Both bonds have $1,000 face value. Bond A has just

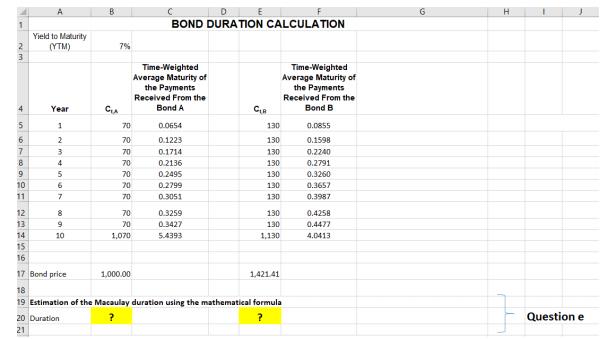

Consider two bonds A and B with payments Ct, where t = 1,2, ...,10. Both bonds have $1,000 face value. Bond A has just been issued, it bears coupon rate of 7%, and it will mature in 10 years. Bond B was issued 5 years ago, when interest rates were higher. This bond has $1,000 face value and bears a 13% coupon rate. When issued, this bond had a 15-year maturity, so its remaining maturity is 10 years. The yield to maturity is 7% (see Cell B2). Using the Excel spreadsheet below, estimate the duration of each of the two bonds A (Cell B20) and B (Cell E20), using the mathematical formula of the Macaulay duration measure. Which bond has the longest duration? Show your calculations and interpret your results. 4 5 6 7 8 9 10 11 A Yield to Maturity (YTM) Year 1 8600 VUAWN 6 9 10 B 20 Duration 21 CA 7% R RRRRRR PR6 70 70 1,070 C D BOND DURATION CALCULATION Time-Weighted Average Maturity of the Payments Received From the Bond A 1,000.00 12 13 14 15 16 17 Bond price 18 19 Estimation of the Macaulay duration using the mathematical formula ? ? 0.0654 0.1223 0.1714 0.2136 0.2495 0.2799 0.3051 E 0.3259 0.3427 5.4393 CLR 130 130 130 130 130 130 130 130 130 1,130 Time-Weighted Average Maturity of the Payments Received From the Bond B 1,421.41 0.0855 0.1598 0.2240 0.2791 0.3260 0.3657 0.3987 0.4258 0.4477 4.0413 G H 1 Question e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts