Question: Consider two bonds, both pay annual interest. Bond C has a coupon of 6% per year, maturity of 5 years, yield to maturity of 12%

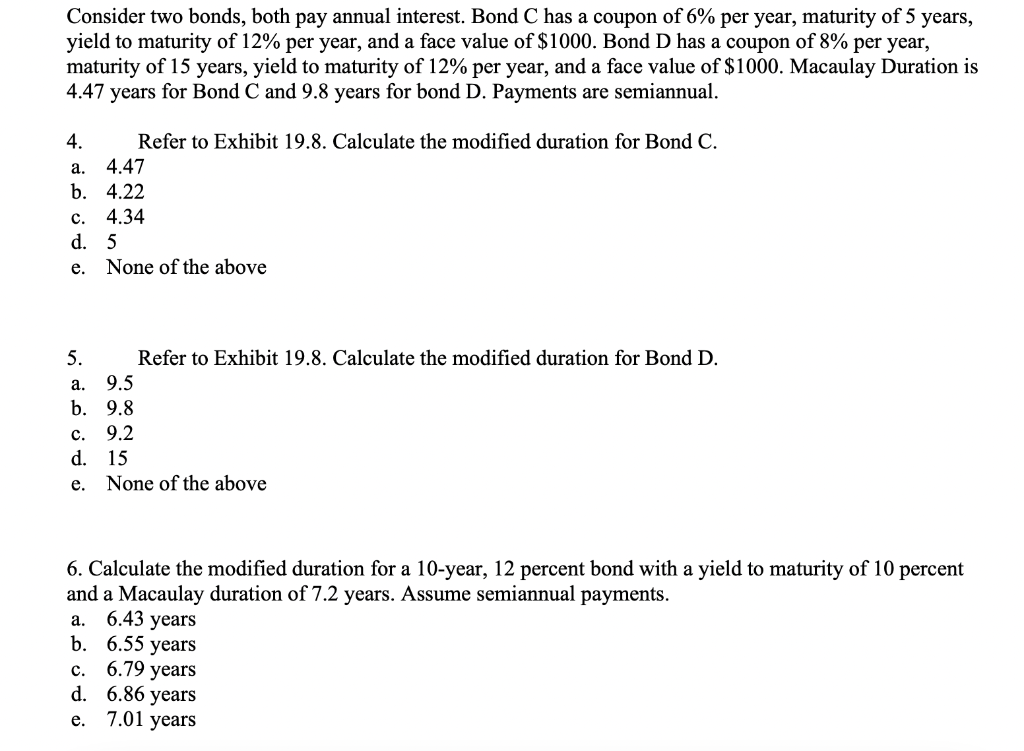

Consider two bonds, both pay annual interest. Bond C has a coupon of 6% per year, maturity of 5 years, yield to maturity of 12% per year, and a face value of $1000. Bond D has a coupon of 8% per year, maturity of 15 years, yield to maturity of 12% per year, and a face value of $1000. Macaulay Duration is 4.47 years for Bond C and 9.8 years for bond D. Payments are semiannual. 4. Refer to Exhibit 19.8. Calculate the modified duration for Bond C. a. 4.47 b. 4.22 c. 4.34 d. 5 e. None of the above 5. Refer to Exhibit 19.8. Calculate the modified duration for Bond D. a. 9.5 b. 9.8 c. 9.2 d. 15 e. None of the above 6. Calculate the modified duration for a 10-year, 12 percent bond with a yield to maturity of 10 percent and a Macaulay duration of 7.2 years. Assume semiannual payments. a. 6.43 years b. 6.55 years c. 6.79 years d. 6.86 years 7.01 years e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts