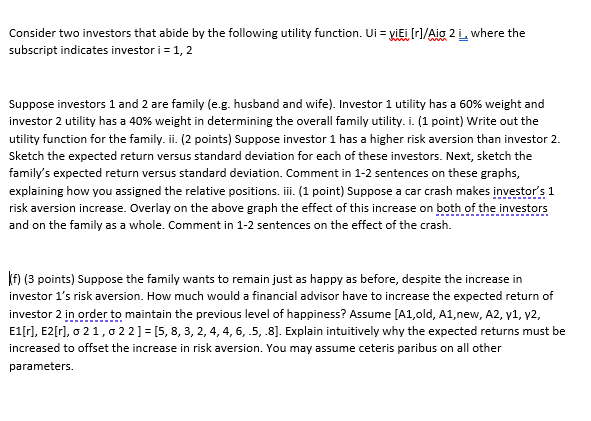

Question: Consider two investors that abide by the following utility function. Ui = viti (r)/Aig 2 1, where the subscript indicates investor i = 1, 2

Consider two investors that abide by the following utility function. Ui = viti (r)/Aig 2 1, where the subscript indicates investor i = 1, 2 Suppose investors 1 and 2 are family (e.g. husband and wife). Investor 1 utility has a 60% weight and investor 2 utility has a 40% weight in determining the overall family utility. i. (1 point) Write out the utility function for the family. ii. (2 points) Suppose investor 1 has a higher risk aversion than investor 2. Sketch the expected return versus standard deviation for each of these investors. Next, sketch the family's expected return versus standard deviation. Comment in 1-2 sentences on these graphs, explaining how you assigned the relative positions. iii. (1 point) Suppose a car crash makes investor's 1 risk aversion increase. Overlay on the above graph the effect of this increase on both of the investors and on the family as a whole. Comment in 1-2 sentences on the effect of the crash. Kt) (3 points) Suppose the family wants to remain just as happy as before, despite the increase in investor l's risk aversion. How much would a financial advisor have to increase the expected return of investor 2 in order to maintain the previous level of happiness? Assume [A1,old, A1, new, A2, v1, v2, E1[r), E2[r],0 21,022 ] = [5,8, 3, 2,4,4,6,5,-8). Explain intuitively why the expected returns must be increased to offset the increase in risk aversion. You may assume ceteris paribus on all other parameters. Consider two investors that abide by the following utility function. Ui = viti (r)/Aig 2 1, where the subscript indicates investor i = 1, 2 Suppose investors 1 and 2 are family (e.g. husband and wife). Investor 1 utility has a 60% weight and investor 2 utility has a 40% weight in determining the overall family utility. i. (1 point) Write out the utility function for the family. ii. (2 points) Suppose investor 1 has a higher risk aversion than investor 2. Sketch the expected return versus standard deviation for each of these investors. Next, sketch the family's expected return versus standard deviation. Comment in 1-2 sentences on these graphs, explaining how you assigned the relative positions. iii. (1 point) Suppose a car crash makes investor's 1 risk aversion increase. Overlay on the above graph the effect of this increase on both of the investors and on the family as a whole. Comment in 1-2 sentences on the effect of the crash. Kt) (3 points) Suppose the family wants to remain just as happy as before, despite the increase in investor l's risk aversion. How much would a financial advisor have to increase the expected return of investor 2 in order to maintain the previous level of happiness? Assume [A1,old, A1, new, A2, v1, v2, E1[r), E2[r],0 21,022 ] = [5,8, 3, 2,4,4,6,5,-8). Explain intuitively why the expected returns must be increased to offset the increase in risk aversion. You may assume ceteris paribus on all other parameters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts