Question: Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume the discount rate for both projects is 8 percent. Project A:

| Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume the discount rate for both projects is 8 percent. |

| Project A: | Nagano NP-30. |

| Professional clubs that will take an initial investment of $910,000 at Time 0. Introduction of new product at Year 6 will terminate further cash flows from this project. |

| Project B: | Nagano NX-20. |

| High-end amateur clubs that will take an initial investment of $655,000 at Time 0. Introduction of new product at Year 6 will terminate further cash flows from this project. |

| Year | NP-30 | NX-20 | ||||

| 0 | $ | 910,000 | $ | 655,000 | ||

| 1 | 337,000 | 258,000 | ||||

| 2 | 327,000 | 264,000 | ||||

| 3 | 302,000 | 248,000 | ||||

| 4 | 293,000 | 228,000 | ||||

| 5 | 203,000 | 178,000 | ||||

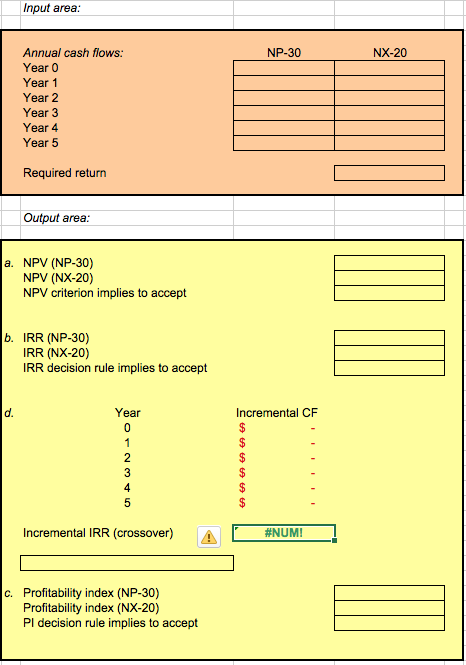

| Complete the following:

| ||||||

Input area: NP-30 NX-20 Annual cash fiows Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Required return Output area a. NPV (NP-30) NPV (NX-20) NPV criterion implies to accept b. IRR (NP-30) IRR (NX-20) IRR decision rule implies to accept d. Year Incremental CF Incremental IRR (crossover) A #NUM! c. Profitability index (NP-30) Profitability index (NX-20) Pl decision rule implies to accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts