Question: Consider two mutually exclusive new product launch projects that Nagano Golf, a golf club and manufacturer located in Leamington Spa is considering. Assume the 5-year

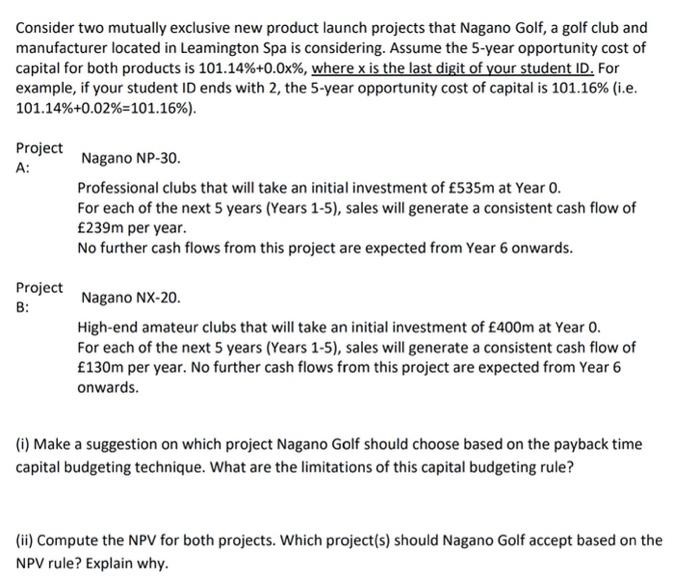

Consider two mutually exclusive new product launch projects that Nagano Golf, a golf club and manufacturer located in Leamington Spa is considering. Assume the 5-year opportunity cost of capital for both products is 101.14% +0.0x%, where x is the last digit of your student ID. For example, if your student ID ends with 2, the 5-year opportunity cost of capital is 101.16% (i.e. 101.14% +0.02% - 101.16%). Project A: Nagano NP-30. Professional clubs that will take an initial investment of 535m at Year 0. For each of the next 5 years (Years 1-5), sales will generate a consistent cash flow of 239m per year. No further cash flows from this project are expected from Year 6 onwards. Project B: Nagano NX-20. High-end amateur clubs that will take an initial investment of 400m at Year 0. For each of the next 5 years (Years 1-5), sales will generate a consistent cash flow of 130m per year. No further cash flows from this project are expected from Year 6 onwards. (i) Make a suggestion on which project Nagano Golf should choose based on the payback time capital budgeting technique. What are the limitations of this capital budgeting rule? (ii) Compute the NPV for both projects. Which project(s) should Nagano Golf accept based on the NPV rule? Explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts