Question: Consider two projects, A and B. Project A's first cash flow is $10,100 and is received three years from today. Future cash flows for Project

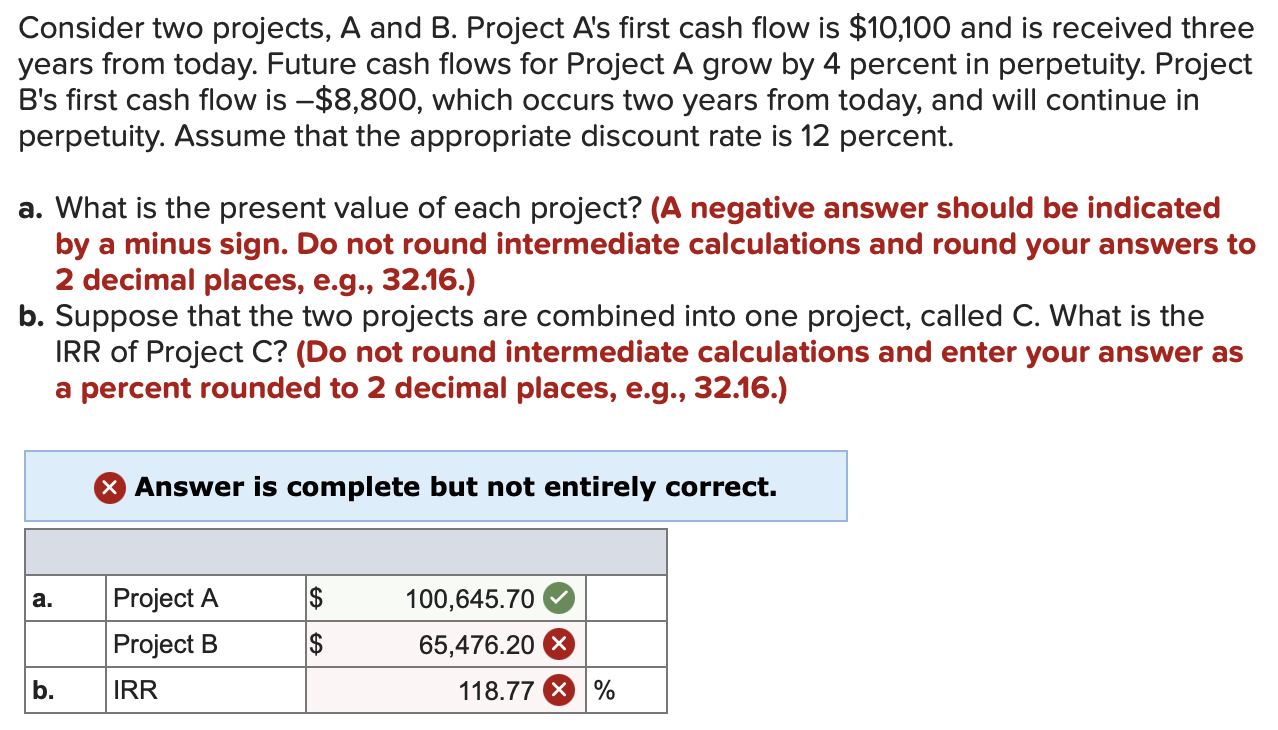

Consider two projects, A and B. Project A's first cash flow is $10,100 and is received three years from today. Future cash flows for Project A grow by 4 percent in perpetuity. Project B's first cash flow is $8,800, which occurs two years from today, and will continue in perpetuity. Assume that the appropriate discount rate is 12 percent. a. What is the present value of each project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Suppose that the two projects are combined into one project, called C. What is the IRR of Project C? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) X Answer is complete but not entirely correct. a. $ Project A Project B IRR 100,645.70 65,476.20 X $ b. 118.77 X %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts