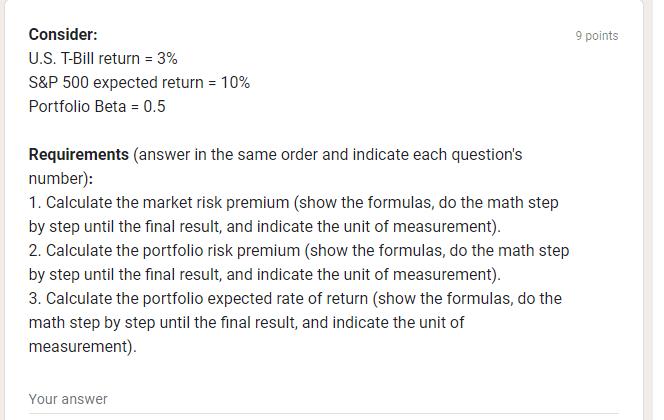

Question: Consider: U.S. T-Bill return = 3% S&P 500 expected return = 10% Portfolio Beta = 0.5 Requirements (answer in the same order and indicate

Consider: U.S. T-Bill return = 3% S&P 500 expected return = 10% Portfolio Beta = 0.5 Requirements (answer in the same order and indicate each question's number): 1. Calculate the market risk premium (show the formulas, do the math step by step until the final result, and indicate the unit of measurement). 2. Calculate the portfolio risk premium (show the formulas, do the math step by step until the final result, and indicate the unit of measurement). 3. Calculate the portfolio expected rate of return (show the formulas, do the math step by step until the final result, and indicate the unit of measurement). Your answer 9 points

Step by Step Solution

There are 3 Steps involved in it

Answer Lets tackle each requirement step by step 1 To calculate the market risk premium we use the f... View full answer

Get step-by-step solutions from verified subject matter experts