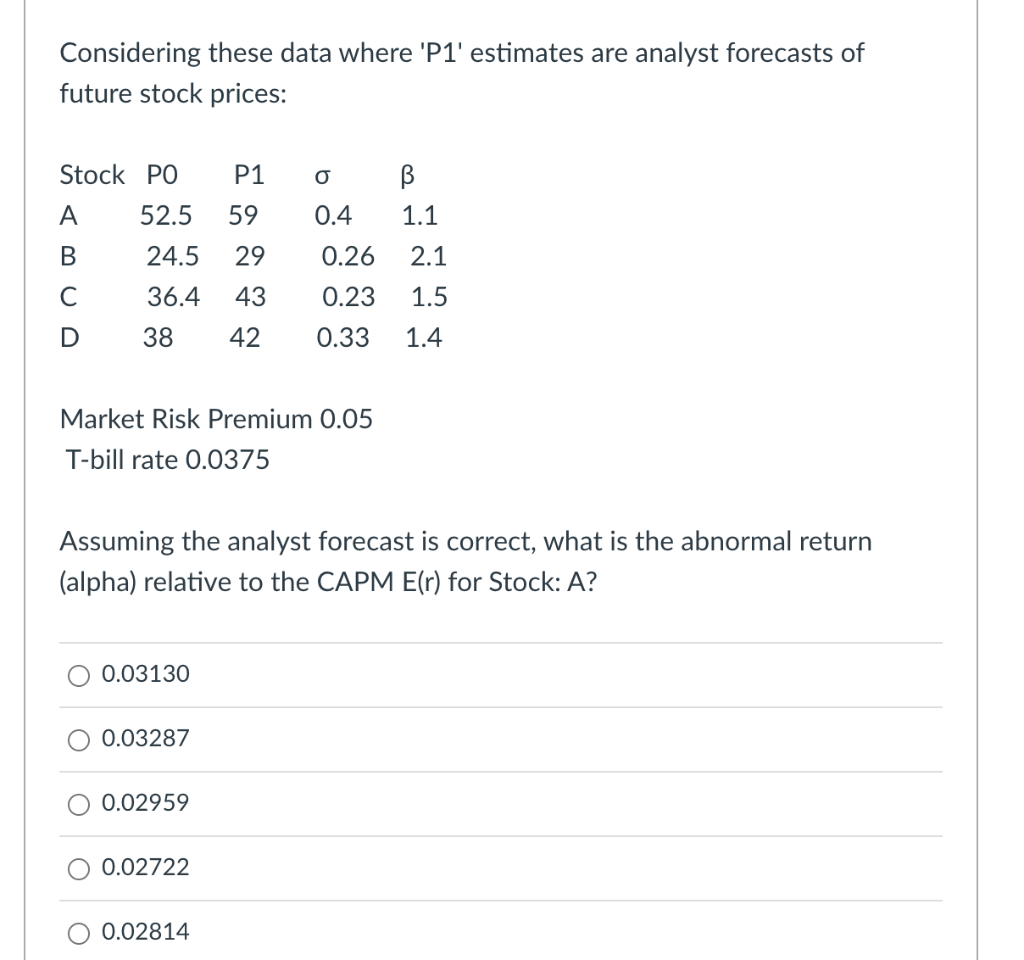

Question: Considering these data where 'Pl' estimates are analyst forecasts of future stock prices: P1 o Stock PO A 52.5 B 1.1 59 0.4 B 24.5

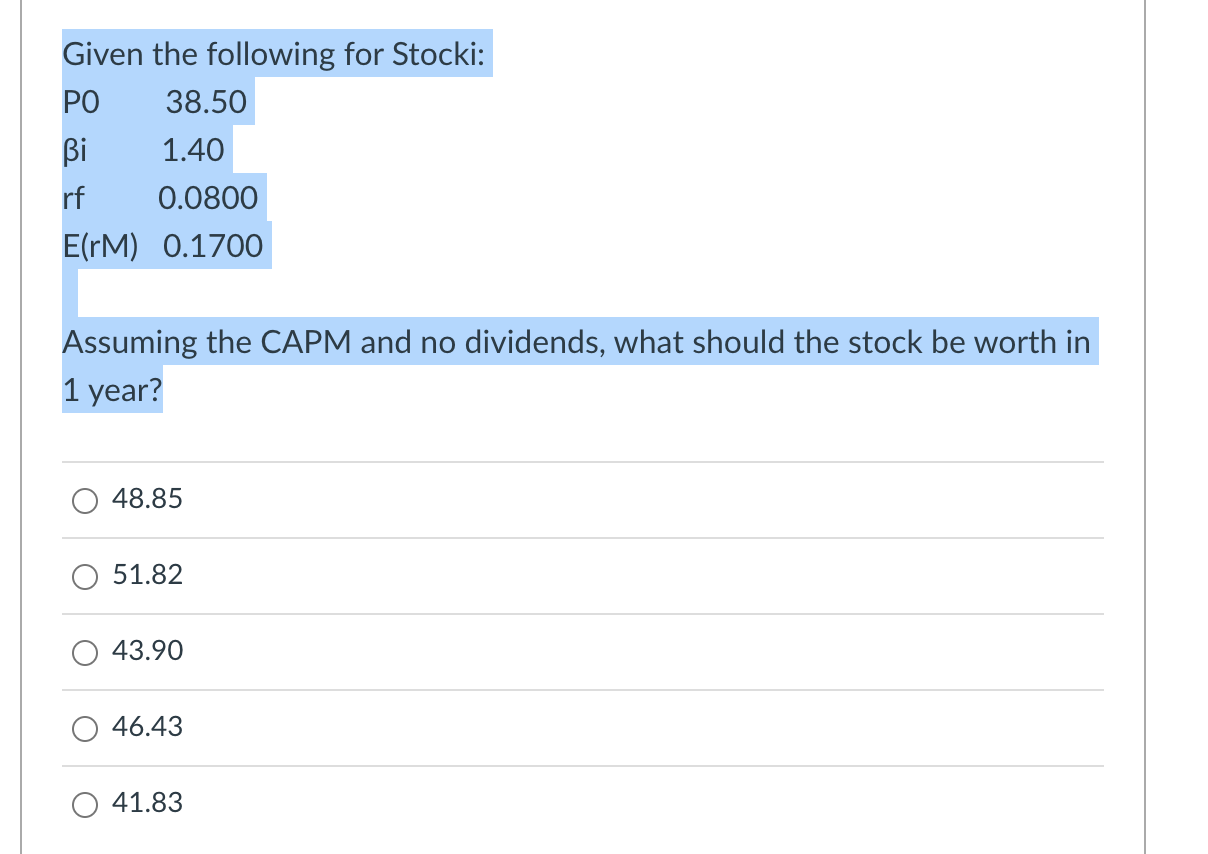

Considering these data where 'Pl' estimates are analyst forecasts of future stock prices: P1 o Stock PO A 52.5 B 1.1 59 0.4 B 24.5 29 0.26 2.1 0.23 36.4 38 43 42 1.5 1.4 D 0.33 Market Risk Premium 0.05 T-bill rate 0.0375 Assuming the analyst forecast is correct, what is the abnormal return (alpha) relative to the CAPM E(r) for Stock: A? 0.03130 0.03287 0.02959 0.02722 0.02814 Given the following for Stocki: PO 38.50 Bi 1.40 rf 0.0800 E(rm) 0.1700 Assuming the CAPM and no dividends, what should the stock be worth in 1 year? 48.85 51.82 43.90 46.43 41.83

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock