Question: Consolidated balance sheet working papers (fair value/book value differential and noncontrolling interest) Pope Corporation acquired a 70% interest in Stubb Corporation on January 1,

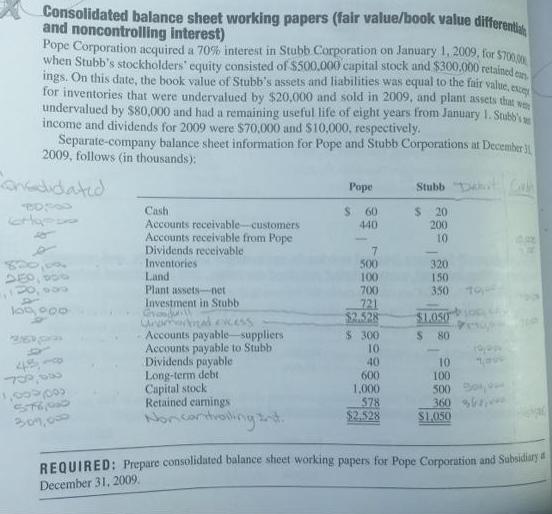

Consolidated balance sheet working papers (fair value/book value differential and noncontrolling interest) Pope Corporation acquired a 70% interest in Stubb Corporation on January 1, 2009, for $700,000 when Stubb's stockholders' equity consisted of $500.000 capital stock and $300,000 retained en ings. On this date, the book value of Stubb's assets and liabilities was equal to the fair value, excey for inventories that were undervalued by $20,000 and sold in 2009, and plant assets that w undervalued by $80,000 and had a remaining useful life of eight years from January 1. Stubb's income and dividends for 2009 were $70,000 and $10,000, respectively. Separate-company balance sheet information for Pope and Stubb Corporations at December 31 2009, follows (in thousands): Candidated Pope Stubb Dobb 80000 Cash $ 60 $ 20 CH000 440 200 Accounts receivable-customers Accounts receivable from Pope Dividends receivable 10 500 320 Inventories Land DEO,00 100 150 700 350 Plant assets-net Investment in Stubb 721 100,000 G $2.528 Amma xCESS $1.050 $300 $ 80 26999 48- 10 Accounts payable suppliers Accounts payable to Stubb Dividends payable Long-term debt, Capital stock 40 10 78,88 600 100 1,000 500 180880 Retained earnings 578 360 % 576,000 $2.528 309,000 $1,050 REQUIRED: Prepare consolidated balance sheet working papers for Pope Corporation and Subsidiary December 31, 2009.

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

All amounts are in Cost of 70 of Stubb 700000 The implied total fair value of Stubb 700000 70 100000... View full answer

Get step-by-step solutions from verified subject matter experts