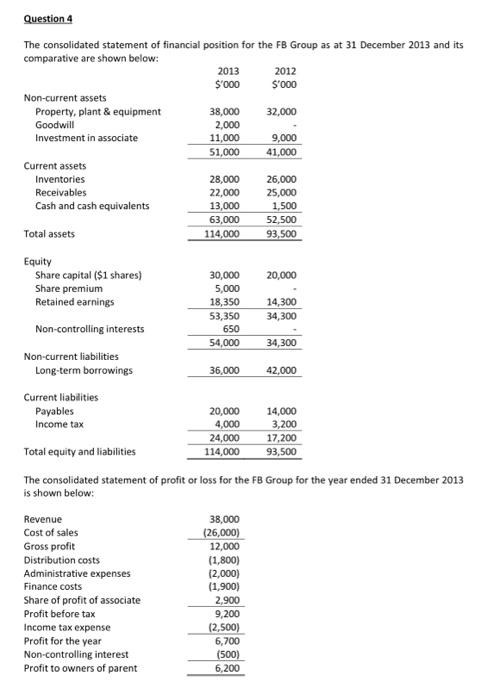

Question: Consolidated Cash flow statement Question 4 Question 4 The consolidated statement of financial position for the FB Group as at 31 December 2013 and its

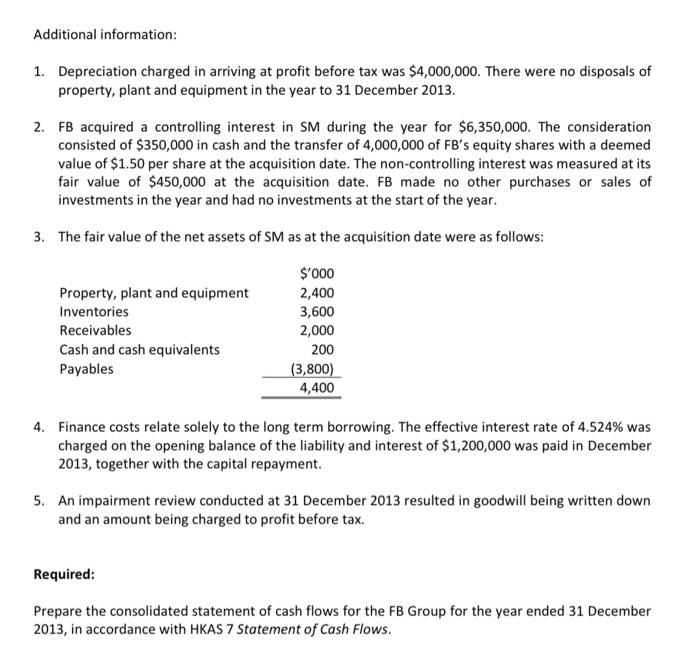

Question 4 The consolidated statement of financial position for the FB Group as at 31 December 2013 and its The consolidated statement of profit of loss for the FB Group for the year ended 31 December 2013 is shown below: 1. Depreciation charged in arriving at profit before tax was $4,000,000. There were no disposals of property, plant and equipment in the year to 31 December 2013. 2. FB acquired a controlling interest in SM during the year for $6,350,000. The consideration consisted of $350,000 in cash and the transfer of 4,000,000 of FB s equity shares with a deemed value of $1.50 per share at the acquisition date. The non-controlling interest was measured at its fair value of $450,000 at the acquisition date. FB made no other purchases or sales of investments in the year and had no investments at the start of the year. 3. The fair value of the net assets of SM as at the acquisition date were as follows: 4. Finance costs relate solely to the long term borrowing. The effective interest rate of 4.524% was charged on the opening balance of the liability and interest of $1,200,000 was paid in December 2013 , together with the capital repayment. 5. An impairment review conducted at 31 December 2013 resulted in goodwill being written down and an amount being charged to profit before tax. Required: Prepare the consolidated statement of cash flows for the FB Group for the year ended 31 December 2013 , in accordance with HKAS 7 Statement of Cash Flows. Question 4 The consolidated statement of financial position for the FB Group as at 31 December 2013 and its The consolidated statement of profit of loss for the FB Group for the year ended 31 December 2013 is shown below: 1. Depreciation charged in arriving at profit before tax was $4,000,000. There were no disposals of property, plant and equipment in the year to 31 December 2013. 2. FB acquired a controlling interest in SM during the year for $6,350,000. The consideration consisted of $350,000 in cash and the transfer of 4,000,000 of FB s equity shares with a deemed value of $1.50 per share at the acquisition date. The non-controlling interest was measured at its fair value of $450,000 at the acquisition date. FB made no other purchases or sales of investments in the year and had no investments at the start of the year. 3. The fair value of the net assets of SM as at the acquisition date were as follows: 4. Finance costs relate solely to the long term borrowing. The effective interest rate of 4.524% was charged on the opening balance of the liability and interest of $1,200,000 was paid in December 2013 , together with the capital repayment. 5. An impairment review conducted at 31 December 2013 resulted in goodwill being written down and an amount being charged to profit before tax. Required: Prepare the consolidated statement of cash flows for the FB Group for the year ended 31 December 2013 , in accordance with HKAS 7 Statement of Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts