Question: Consolidating entries (market value differs from book value) Assume that on January 1, 2013, an investor company acquired 100% of the outstanding voting common stock

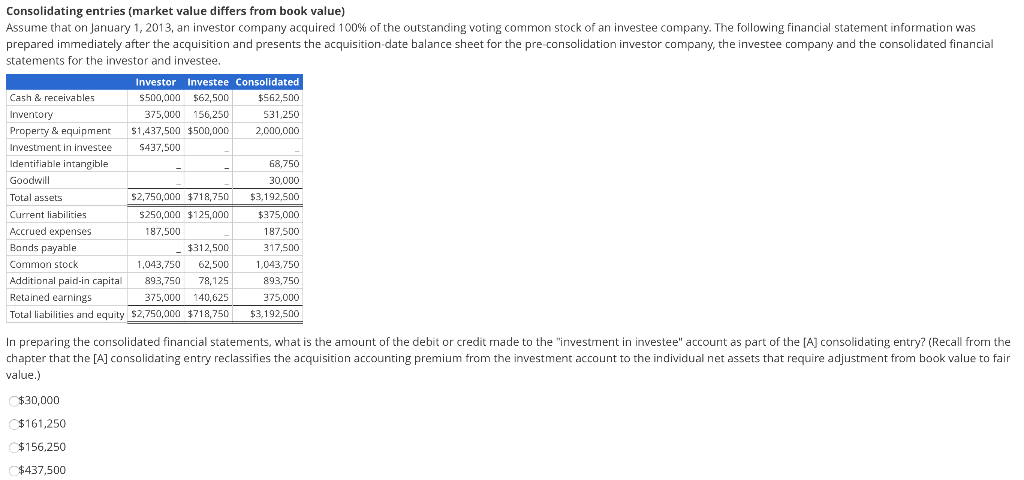

Consolidating entries (market value differs from book value) Assume that on January 1, 2013, an investor company acquired 100% of the outstanding voting common stock of an investee company. The following financial statement information was prepared immediately after the acquisition and presents the acquisition date balance sheet for the pre-consolidation investor company, the investee company and the consolidated financial statements for the investor and investee. Investor Investee Consolidated Cash & receivables $500,000 $62,500 $562,500 Inventory 375,000 156,250 531,250 Property & equipment $1,437,500 $500,000 2,000,000 Investment in investee S437,500 Identifiable intangible 68,750 Goodwill 30,000 Total assets $2,750,000 $718,750 $3.192,500 Current liabilities $250,000 $125,000 $375,000 Accrued expenses 187,500 187,500 Bands payable - $312,500 317,500 Common stock 1,043,750 62,500 1,043,750 Additional paid-in capital 893,750 78,125 893,750 Retained earnings 375,000 140,625 375,000 Total liabilities and equity $2,750,000 $718,750 $3,192,500 In preparing the consolidated financial statements, what is the amount of the debit or credit made to the "investment in investee" account as part of the [A] consolidating entry? (Recall from the chapter that the [A] consolidating entry reclassifies the acquisition accounting premium from the investment account to the individual net assets that require adjustment from book value to fair value.) $30,000 $ 161,250 $156,250 $437,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts