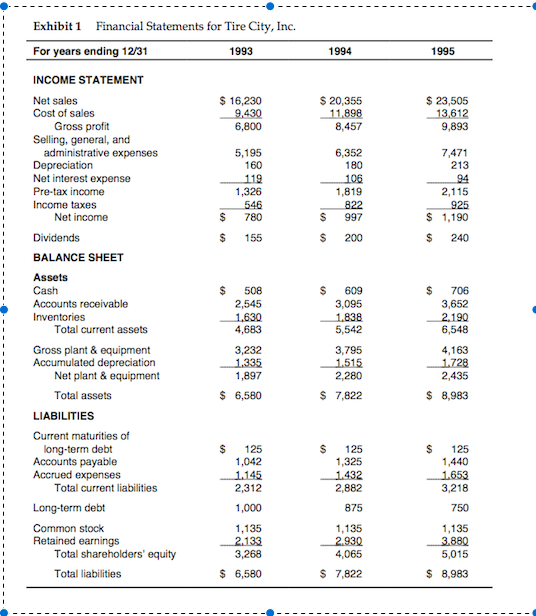

Question: Construct a cash flow statement for both years 1994 1995 $ 20,355 11.898 8,457 $ 23,505 13,612 9,893 6,352 180 106 1,819 822 997 7,471

Construct a cash flow statement for both years

Construct a cash flow statement for both years

1994 1995 $ 20,355 11.898 8,457 $ 23,505 13,612 9,893 6,352 180 106 1,819 822 997 7,471 213 94 2,115 925 $ 1,190 S 240 $ $ 200 Exhibit 1 Financial Statements for Tire City, Inc. For years ending 12/31 1993 INCOME STATEMENT Net sales $ 16,230 Cost of sales 9,430 Gross profit 6,800 Selling, general, and administrative expenses 5,195 Depreciation 160 Net interest expense 119 Pre-tax income 1,326 Income taxes 546 Net income $ 780 Dividends $ 155 BALANCE SHEET Assets Cash $ 508 Accounts receivable 2,545 Inventories 1.630 Total current assets 4,683 Gross plant & equipment 3,232 Accumulated depreciation Net plant & equipment 1,897 Total assets $ 6,580 LIABILITIES Current maturities of long-term debt $ 125 Accounts payable 1,042 Accrued expenses Total current liabilities 2,312 Long-term debt 1,000 Common stock 1,135 Retained earnings 2.133 Total shareholders' equity 3,268 Total liabilities $ 6,580 $ 609 3,095 1.838 5,542 3,795 1.515 2,280 $ 706 3,652 2.190 6,548 4,163 1.728 2,435 1.335 $ 7,822 $ 8,983 1.145 $ 125 1,325 1.432 2,882 875 $ 125 1,440 1.653 3,218 750 1,135 2.930 4,065 1,135 3.889 5,015 $ 7,822 $ 8,983 1994 1995 $ 20,355 11.898 8,457 $ 23,505 13,612 9,893 6,352 180 106 1,819 822 997 7,471 213 94 2,115 925 $ 1,190 S 240 $ $ 200 Exhibit 1 Financial Statements for Tire City, Inc. For years ending 12/31 1993 INCOME STATEMENT Net sales $ 16,230 Cost of sales 9,430 Gross profit 6,800 Selling, general, and administrative expenses 5,195 Depreciation 160 Net interest expense 119 Pre-tax income 1,326 Income taxes 546 Net income $ 780 Dividends $ 155 BALANCE SHEET Assets Cash $ 508 Accounts receivable 2,545 Inventories 1.630 Total current assets 4,683 Gross plant & equipment 3,232 Accumulated depreciation Net plant & equipment 1,897 Total assets $ 6,580 LIABILITIES Current maturities of long-term debt $ 125 Accounts payable 1,042 Accrued expenses Total current liabilities 2,312 Long-term debt 1,000 Common stock 1,135 Retained earnings 2.133 Total shareholders' equity 3,268 Total liabilities $ 6,580 $ 609 3,095 1.838 5,542 3,795 1.515 2,280 $ 706 3,652 2.190 6,548 4,163 1.728 2,435 1.335 $ 7,822 $ 8,983 1.145 $ 125 1,325 1.432 2,882 875 $ 125 1,440 1.653 3,218 750 1,135 2.930 4,065 1,135 3.889 5,015 $ 7,822 $ 8,983

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts