Question: Construct a Risk Parity (RP) portfolio using the two asset classes. Betas of each equity class (against the equal weighted portfolio) are as provided in

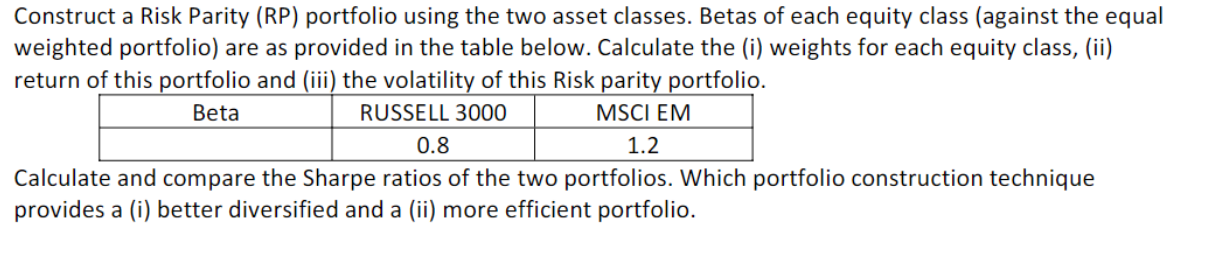

Construct a Risk Parity (RP) portfolio using the two asset classes. Betas of each equity class (against the equal weighted portfolio) are as provided in the table below. Calculate the (i) weights for each equity class, (ii) return of this portfolio and (iii) the volatility of this Risk parity portfolio. Beta RUSSELL 3000 MSCI EM 0.8 1.2 Calculate and compare the Sharpe ratios of the two portfolios. Which portfolio construction technique provides a (i) better diversified and a (ii) more efficient portfolio. Construct a Risk Parity (RP) portfolio using the two asset classes. Betas of each equity class (against the equal weighted portfolio) are as provided in the table below. Calculate the (i) weights for each equity class, (ii) return of this portfolio and (iii) the volatility of this Risk parity portfolio. Beta RUSSELL 3000 MSCI EM 0.8 1.2 Calculate and compare the Sharpe ratios of the two portfolios. Which portfolio construction technique provides a (i) better diversified and a (ii) more efficient portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts