Question: Construct a simple Excel spreadsheet using the Cash Flow Before Debt Service and Net Operating Income numbers on the next page. Please ignore the debt

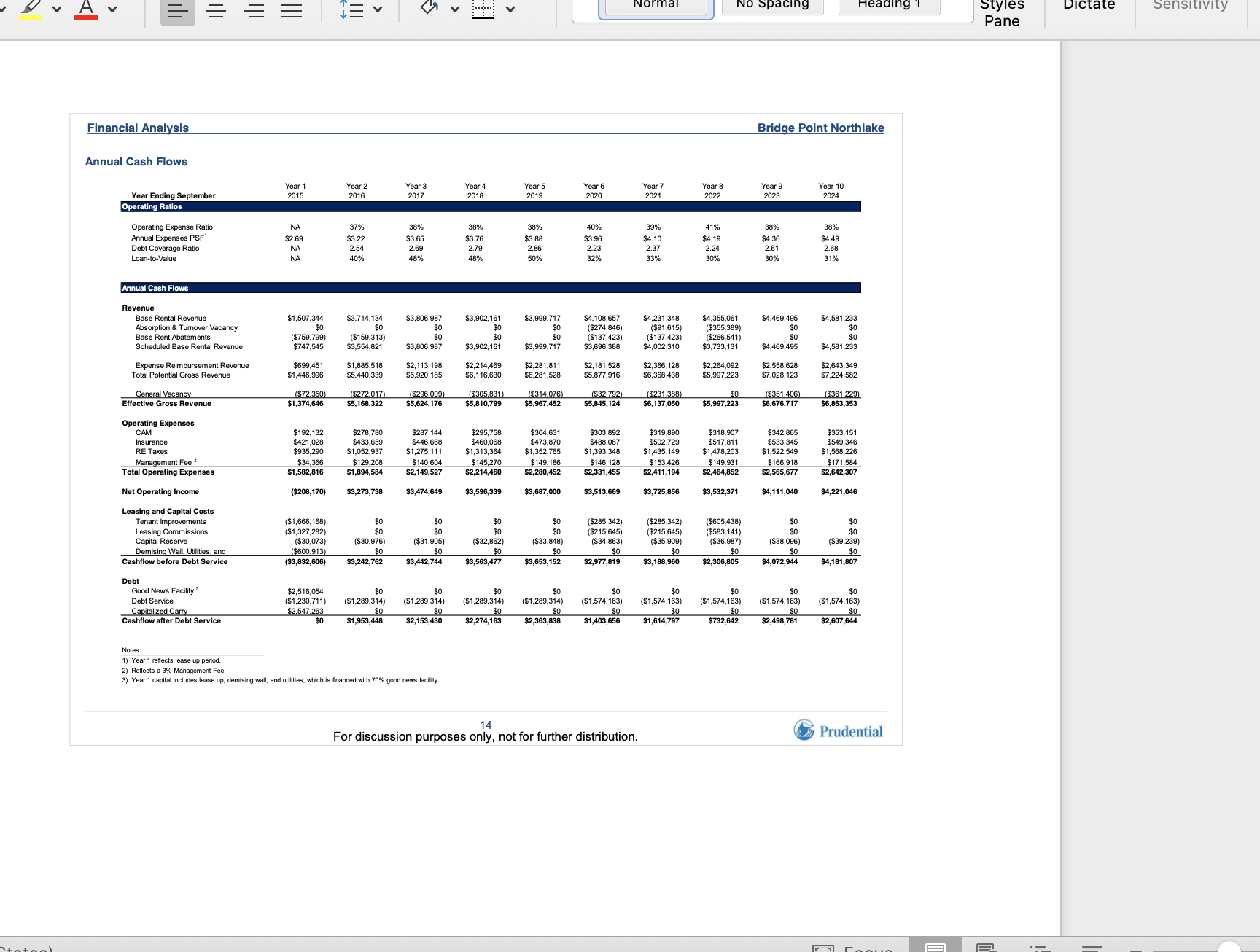

Construct a simple Excel spreadsheet using the Cash Flow Before Debt Service and Net Operating Income numbers on the next page. Please ignore the debt service numbers on the next page, as you will create your own debt service. 1. Assume you are buying the building at the beginning of year 4 (2018) for $68,500,000. Based on that purchase price, what are the annual cash-oncost returns, by year? What is the unleveraged IRR on that purchase through 2024 (assume a 5.5\% residual cap rate on 2024 Net operating income at the end of 2024)? 2. Now, finance 50% of the purchase price with interest only financing (fixed at 5.75% annually) for the term of your ownership. What is the resulting leveraged IRR for your equity? What is the DSCR (debt service coverage ratio) on the first mortgage debt, by year? 3. Next, in addition to the first mortgage financing, add mezzanine financing on top of that from 50% to 75% of the purchase price (also interest only, at a 7.50% annual rate). What is the leveraged equity IRR now? What is the DSCR on the combined first mortgage and mezzanine debt, by year? Other questions: 1. What is the blended interest rate for all the purchaser's debt, using both the first mortgage and mezzanine debt as described above? 2. What issues do you think the first mortgage and mezzanine lenders might be struggling with as they consider lending on your deal? 3. What level of debt is the most comfortable for you over the projected ownership term? Why? Financial Analysis Bridge Point Northlake An Notes: 1) Year 1 reflects lease up period. 2) Reflects a 3% Management Fee. 3) Year 1 capital includes lease up, demising wall, and utilities, which is fnanced with 70% good news facility. 14 For discussion purposes only, not for further distribution. Construct a simple Excel spreadsheet using the Cash Flow Before Debt Service and Net Operating Income numbers on the next page. Please ignore the debt service numbers on the next page, as you will create your own debt service. 1. Assume you are buying the building at the beginning of year 4 (2018) for $68,500,000. Based on that purchase price, what are the annual cash-oncost returns, by year? What is the unleveraged IRR on that purchase through 2024 (assume a 5.5\% residual cap rate on 2024 Net operating income at the end of 2024)? 2. Now, finance 50% of the purchase price with interest only financing (fixed at 5.75% annually) for the term of your ownership. What is the resulting leveraged IRR for your equity? What is the DSCR (debt service coverage ratio) on the first mortgage debt, by year? 3. Next, in addition to the first mortgage financing, add mezzanine financing on top of that from 50% to 75% of the purchase price (also interest only, at a 7.50% annual rate). What is the leveraged equity IRR now? What is the DSCR on the combined first mortgage and mezzanine debt, by year? Other questions: 1. What is the blended interest rate for all the purchaser's debt, using both the first mortgage and mezzanine debt as described above? 2. What issues do you think the first mortgage and mezzanine lenders might be struggling with as they consider lending on your deal? 3. What level of debt is the most comfortable for you over the projected ownership term? Why? Financial Analysis Bridge Point Northlake An Notes: 1) Year 1 reflects lease up period. 2) Reflects a 3% Management Fee. 3) Year 1 capital includes lease up, demising wall, and utilities, which is fnanced with 70% good news facility. 14 For discussion purposes only, not for further distribution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts