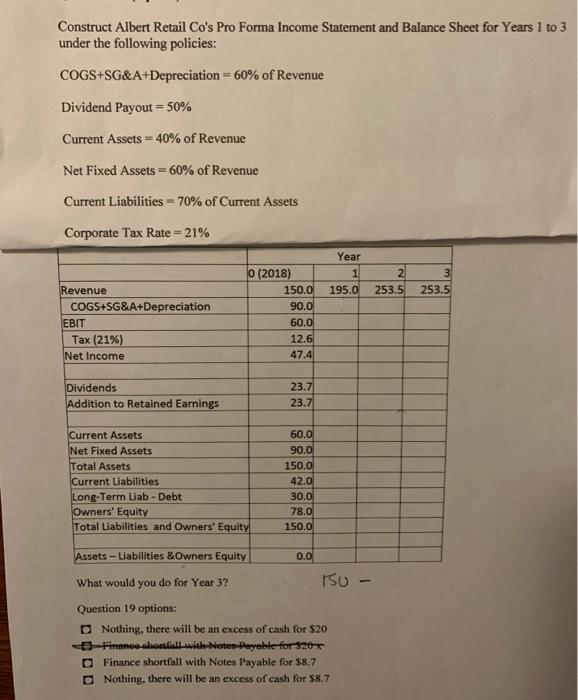

Question: Construct Albert Retail Co's Pro Forma Income Statement and Balance Sheet for Years 1 to 3 under the following policies: COGS+SG&A+Depreciation = 60% of Revenue

Construct Albert Retail Co's Pro Forma Income Statement and Balance Sheet for Years 1 to 3 under the following policies: COGS+SG&A+Depreciation = 60% of Revenue Dividend Payout= 50% Current Assets = 40% of Revenue Net Fixed Assets = 60% of Revenue Current Liabilities -70% of Current Assets Corporate Tax Rate = 21% Year 1 195.0 3 2 253.5 253.5 Revenue COGS+SG&A+Depreciation EBIT Tax (21%) Net Income 0 (2018) 150.0 90.0 60.0 12.6 47.4 Dividends Addition to Retained Earnings 23.7 23.7 Current Assets Net Fixed Assets Total Assets Current Liabilities Long-Term Liab - Debt Owners' Equity Total Liabilities and Owners' Equity 60.0 90.0 150.0 42.0 30.0 78.0 150.0 Assets - Liabilities &Owners Equity 0.0 What would you do for Year 3? 150- Question 19 options: Nothing, there will be an excess of cash for $20 - Finance-slotfall with Notes Payable for 320 Finance shortfall with Notes Payable for $8.7 Nothing, there will be an excess of cash for $8.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts