Question: Construct the forecasting cash flow statement (Excel) based on Exhibit 7. Note: ignoring the interests, you should be able to calculate the depreciation through the

Construct the forecasting cash flow statement (Excel) based on Exhibit 7. Note: ignoring the interests, you should be able to calculate the depreciation through the CAPEX and Net PPE to determine the operating cash flow.

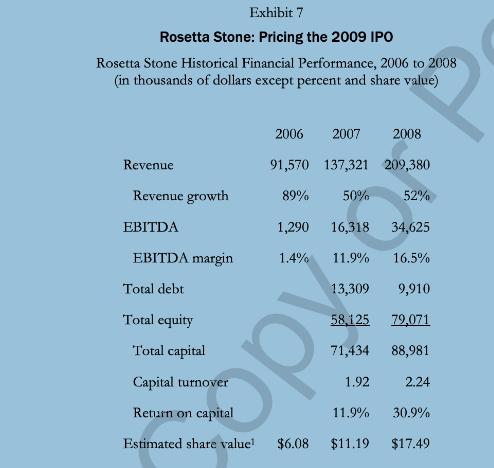

Exhibit 7 Rosetta Stone: Pricing the 2009 IPO Rosetta Stone Historical Financial Performance, 2006 to 2008 (in thousands of dollars except percent and share value) Revenue Revenue growth EBITDA EBITDA margin Total debt Total equity Total capital Capital turnover 2006 2007 2008 91,570 137,321 209,380 89% 52% 1,290 16,318 34,625 1.4% 11.9% 16.5% 13,309 58,125 Return on capital Estimated share value d Sp $6.08 50% 71,434 1.92 11.9% 9,910 79,071 88,981 2.24 30.9% $11.19 $17.49

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Rosetta Stone Forecasting Cash Flow Statement 20092011 Assumptions Revenue growth rates 2009 40 2010 ... View full answer

Get step-by-step solutions from verified subject matter experts