Question: Continue solving the problem, On January 1, 2026, the Mamaya Na Company was acquired by a larger conglomerate in the name of Ayoko Na

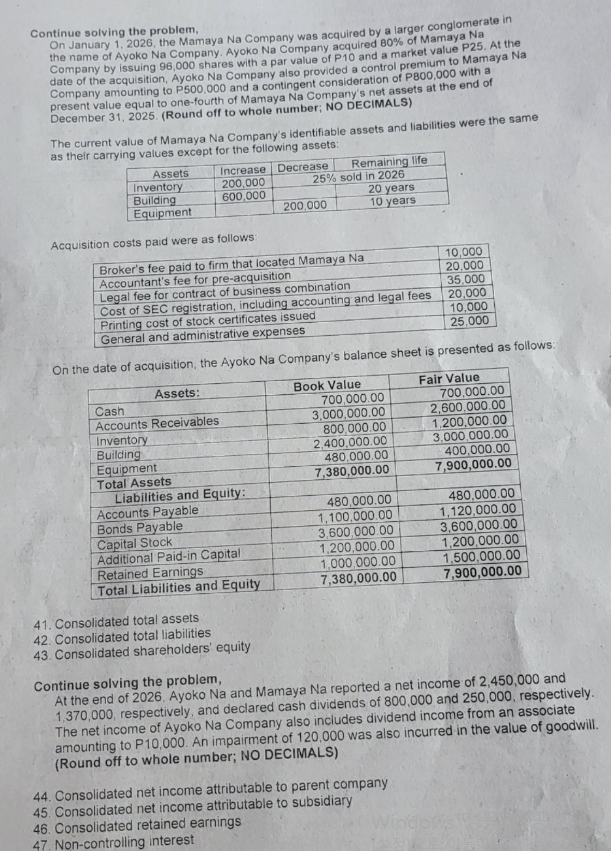

Continue solving the problem, On January 1, 2026, the Mamaya Na Company was acquired by a larger conglomerate in the name of Ayoko Na Company. Ayoko Na Company acquired 80% of Mamaya Na Company by issuing 96,000 shares with a par value of P10 and a market value P25. At the date of the acquisition, Ayoko Na Company also provided a control premium to Mamaya Na Company amounting to P500,000 and a contingent consideration of P800,000 with a present value equal to one-fourth of Mamaya Na Company's net assets at the end of December 31, 2025. (Round off to whole number; NO DECIMALS) The current value of Mamaya Na Company's identifiable assets and liabilities were the same as their carrying values except for the following assets: Assets Inventory Building Increase Decrease Remaining life 200,000 600,000 25% sold in 2026 20 years Equipment 200,000 10 years Acquisition costs paid were as follows: Broker's fee paid to firm that located Mamaya Na 10,000 Accountant's fee for pre-acquisition 20.000 Legal fee for contract of business combination 35,000 Cost of SEC registration, including accounting and legal fees 20,000 Printing cost of stock certificates issued 10,000 General and administrative expenses 25,000 On the date of acquisition, the Ayoko Na Company's balance sheet is presented as follows: Assets: Book Value Cash Accounts Receivables Inventory Building 700,000.00 3,000,000.00 800,000.00 2,400,000.00 Fair Value 700,000.00 2,600.000.00 1,200,000.00 3,000,000.00 Equipment 480,000.00 400,000.00 Total Assets 7,380,000.00 7,900,000.00 Liabilities and Equity: Accounts Payable 480,000.00 480,000.00 Bonds Payable 1,100,000.00 1,120,000.00 Capital Stock 3,600,000.00 3,600,000.00 Additional Paid-in Capital 1,200,000.00 1,200,000.00 Retained Earnings 1,000,000.00 1,500,000.00 Total Liabilities and Equity 7,380,000.00 7,900,000.00 41. Consolidated total assets 42. Consolidated total liabilities 43. Consolidated shareholders' equity. Continue solving the problem, At the end of 2026, Ayoko Na and Mamaya Na reported a net income of 2,450,000 and 1,370,000, respectively, and declared cash dividends of 800,000 and 250,000, respectively. The net income of Ayoko Na Company also includes dividend income from an associate amounting to P10,000. An impairment of 120,000 was also incurred in the value of goodwill. (Round off to whole number; NO DECIMALS) 44. Consolidated net income attributable to parent company 45. Consolidated net income attributable to subsidiary 46. Consolidated retained earnings 47. Non-controlling interest ndows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts