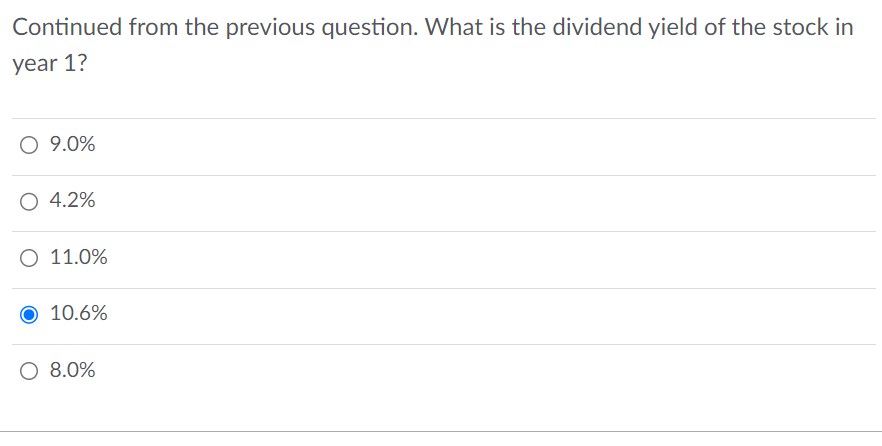

Question: Continued from the previous question. What is the dividend yield of the stock in year 1 ? 9.0 4.2 11.0 10.6 8.0 Continued from the

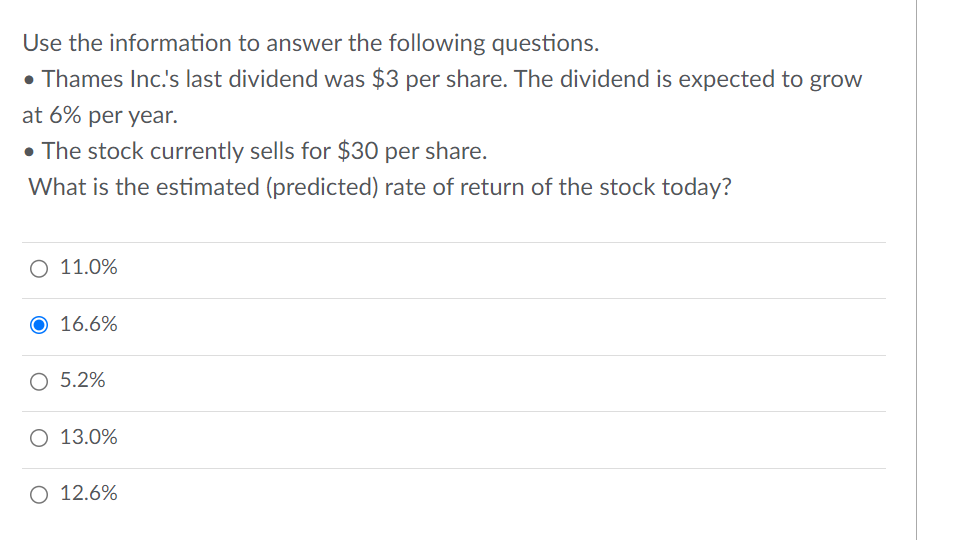

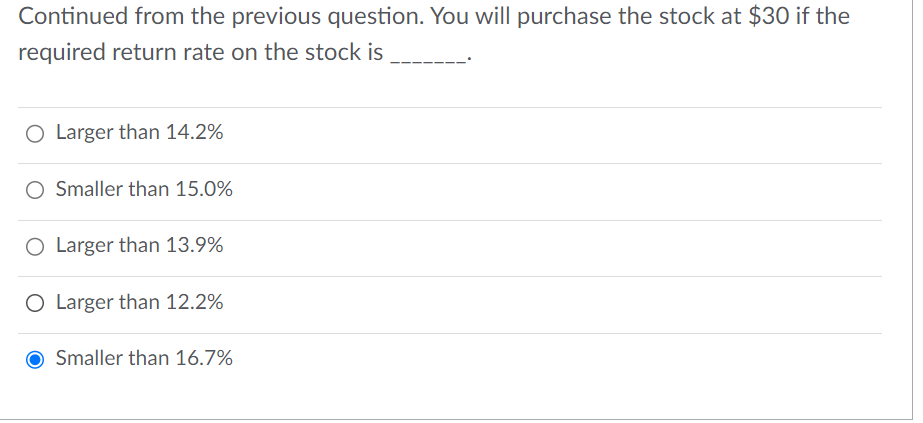

Continued from the previous question. What is the dividend yield of the stock in year 1 ? \9.0 \4.2 \11.0 \10.6 \8.0 Continued from the previous question. You will purchase the stock at \\( \\$ 30 \\) if the required return rate on the stock is Larger than \14.2 Smaller than 15.0\\% Larger than \13.9 Larger than \12.2 Smaller than \16.7 Use the information to answer the following questions. - Thames Inc.'s last dividend was \\( \\$ 3 \\) per share. The dividend is expected to grow at \6 per year. - The stock currently sells for \\( \\$ 30 \\) per share. What is the estimated (predicted) rate of return of the stock today? \11.0 \16.6 \5.2 \13.0 \12.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts