Question: Continuous Time Financial Mathematics We work in the Black-Scholes model A6. Suppose S yields one dividend payment at the deterministic time U E (0,T) with

Continuous Time Financial Mathematics

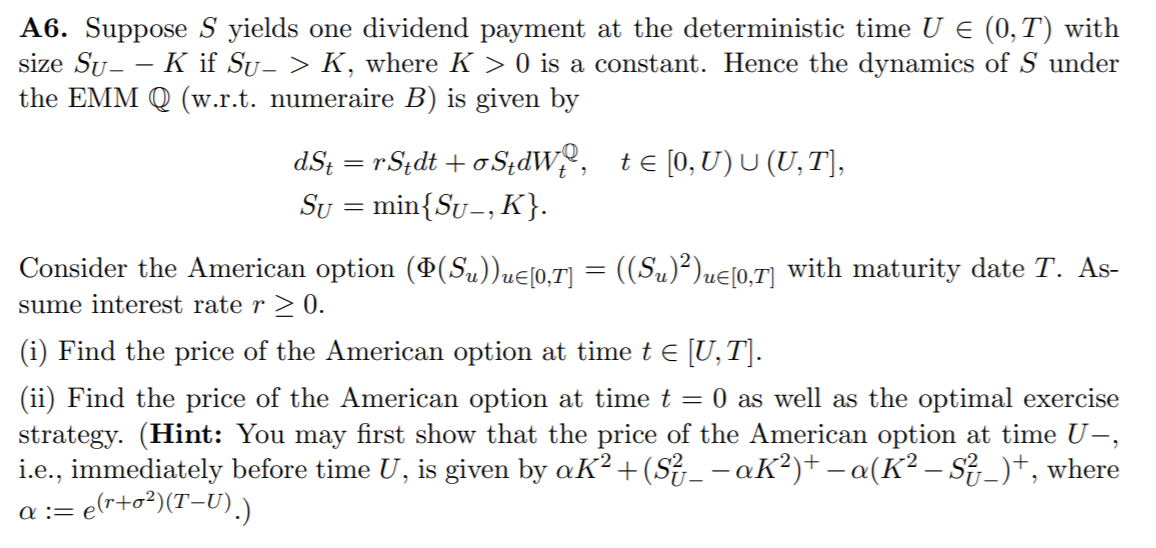

We work in the Black-Scholes model A6. Suppose S yields one dividend payment at the deterministic time U E (0,T) with size Su- K if Su-> K, where K > 0 is a constant. Hence the dynamics of S under the EMM Q (w.r.t. numeraire B) is given by te [O,U) U (U,T], dS4 = rSdt +oStdw, Su = min{Su-, K}. Consider the American option (O(Sul)ue[0,1] = ((Su)?)uc[0,1] with maturity date T. As- sume interest rate r > 0. (i) Find the price of the American option at time t E (U,T]. (ii) Find the price of the American option at time t = 0 as well as the optimal exercise strategy. (Hint: You may first show that the price of the American option at time U-, i.e., immediately before time U, is given by aK2 +(SE_ - aK2)+ - a(K SY_)+, where = e(r+o?)(T-U).) a:= We work in the Black-Scholes model A6. Suppose S yields one dividend payment at the deterministic time U E (0,T) with size Su- K if Su-> K, where K > 0 is a constant. Hence the dynamics of S under the EMM Q (w.r.t. numeraire B) is given by te [O,U) U (U,T], dS4 = rSdt +oStdw, Su = min{Su-, K}. Consider the American option (O(Sul)ue[0,1] = ((Su)?)uc[0,1] with maturity date T. As- sume interest rate r > 0. (i) Find the price of the American option at time t E (U,T]. (ii) Find the price of the American option at time t = 0 as well as the optimal exercise strategy. (Hint: You may first show that the price of the American option at time U-, i.e., immediately before time U, is given by aK2 +(SE_ - aK2)+ - a(K SY_)+, where = e(r+o?)(T-U).) a:=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts