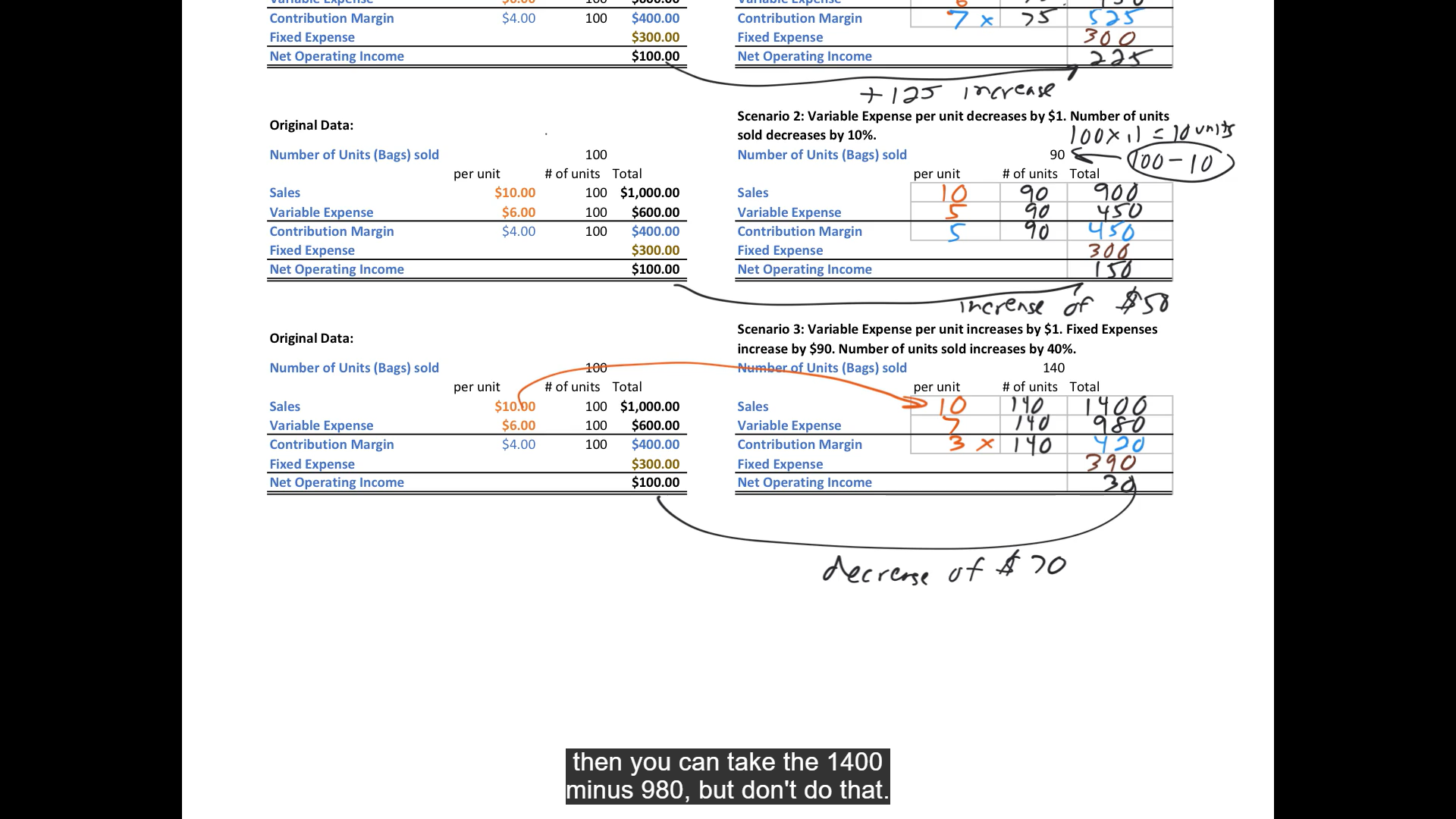

Question: Contribution Margin $4.00 100 $400.00 Contribution Margin 7x 75 525 Fixed Expense $300.00 Fixed Expense 300 Net Operating Income $100.00 Net Operating Income +125 increase

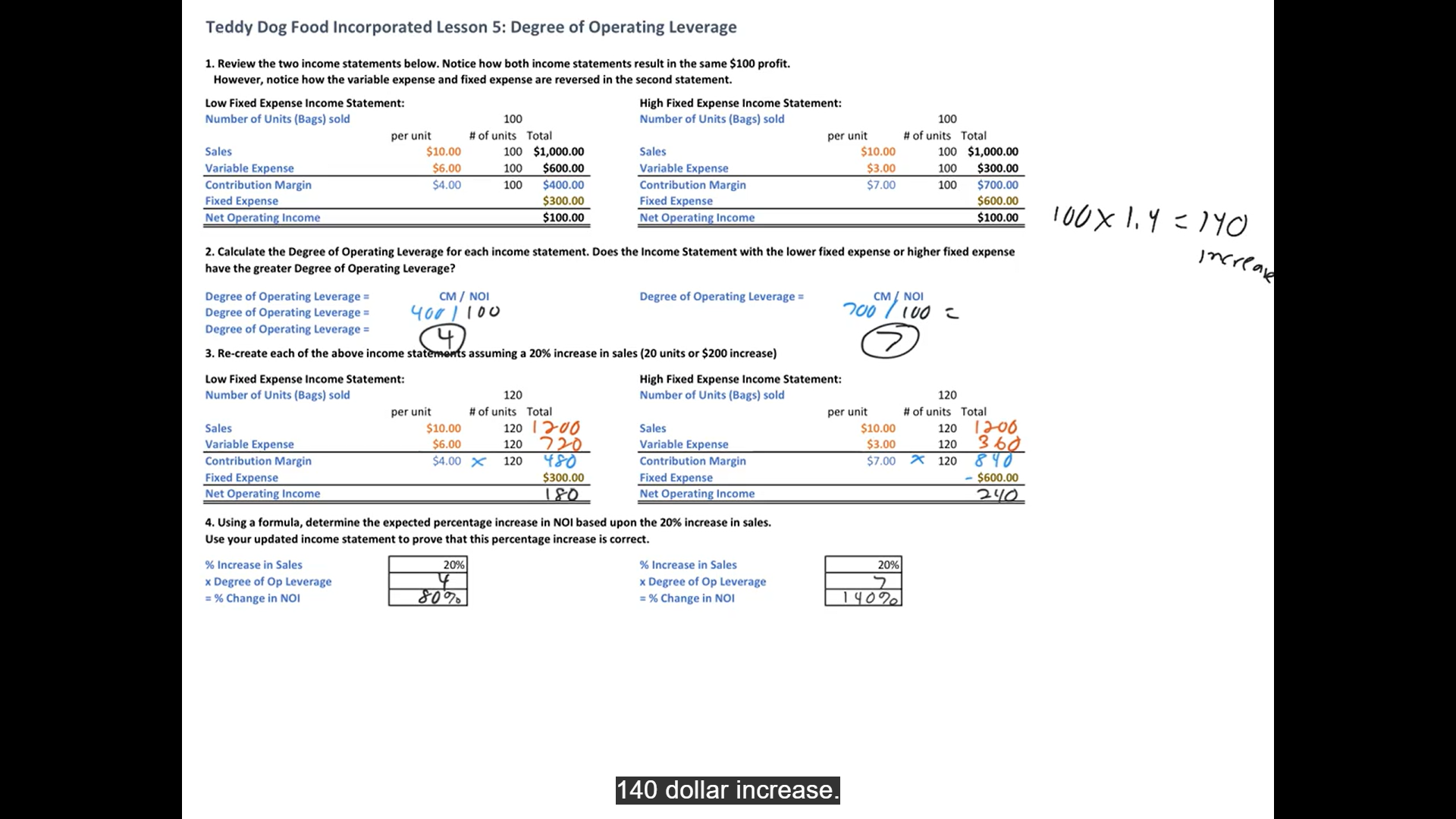

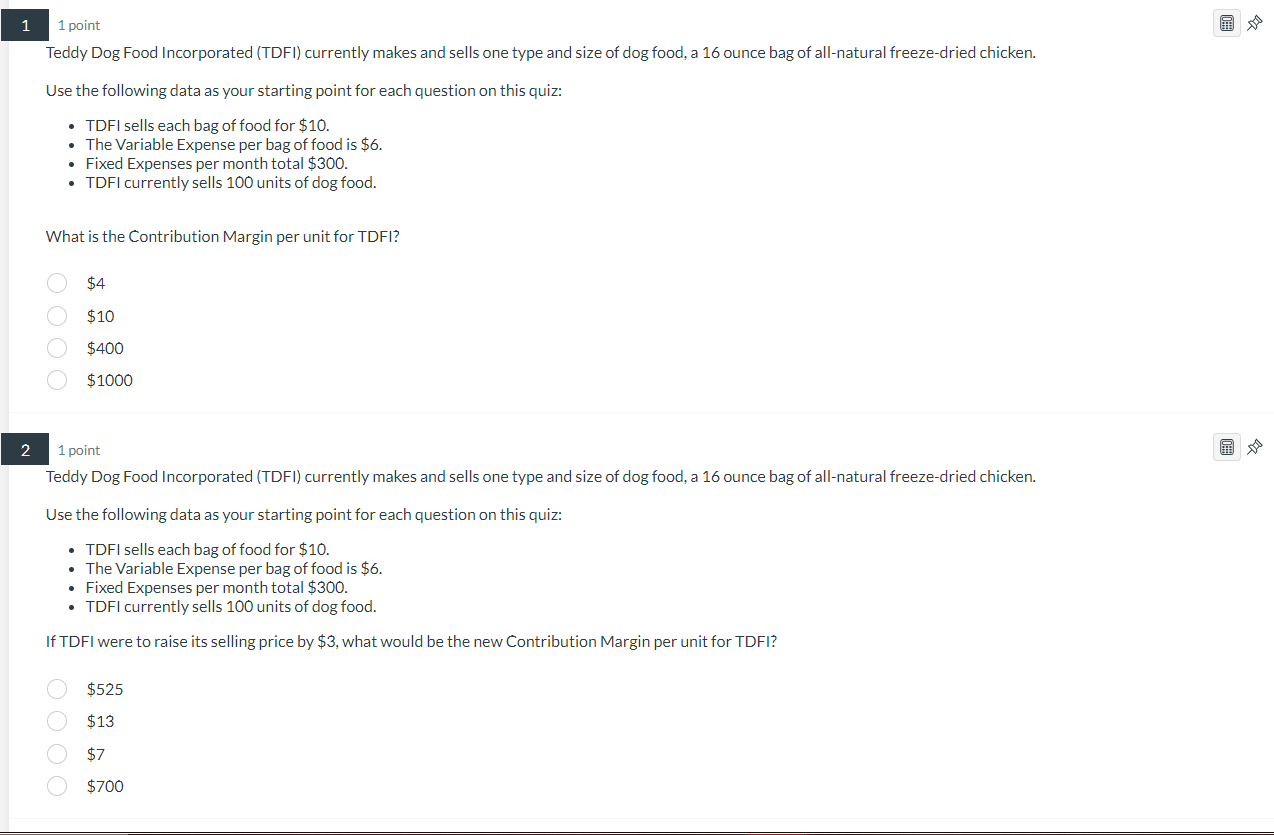

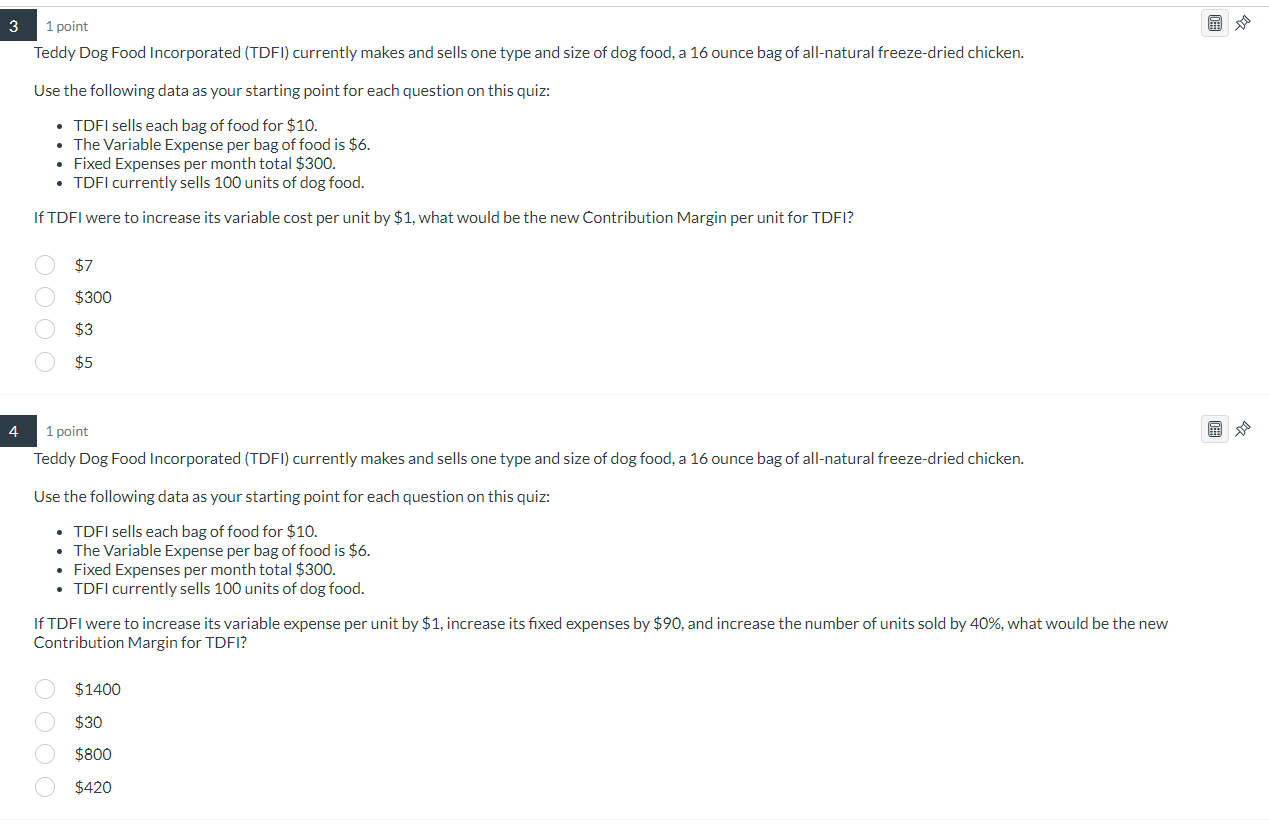

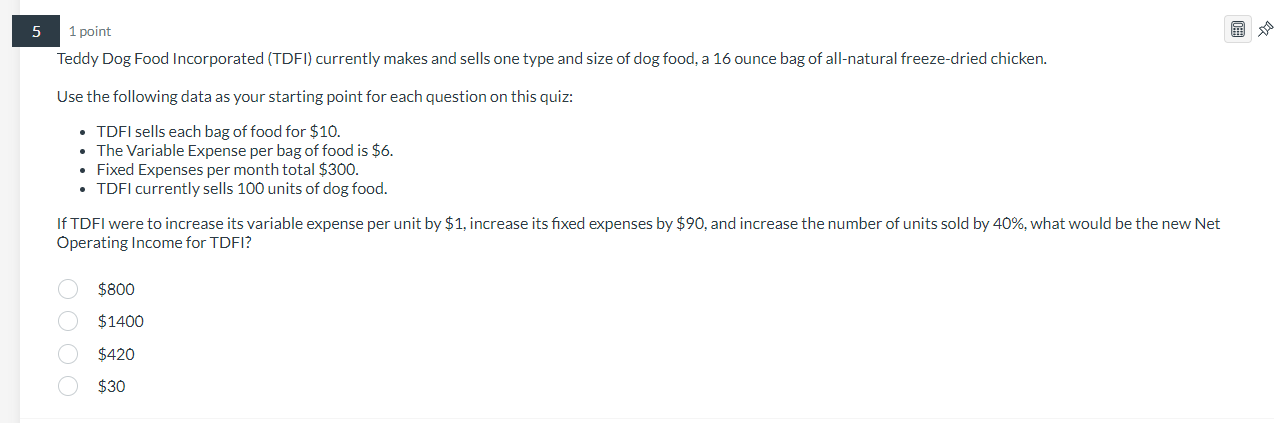

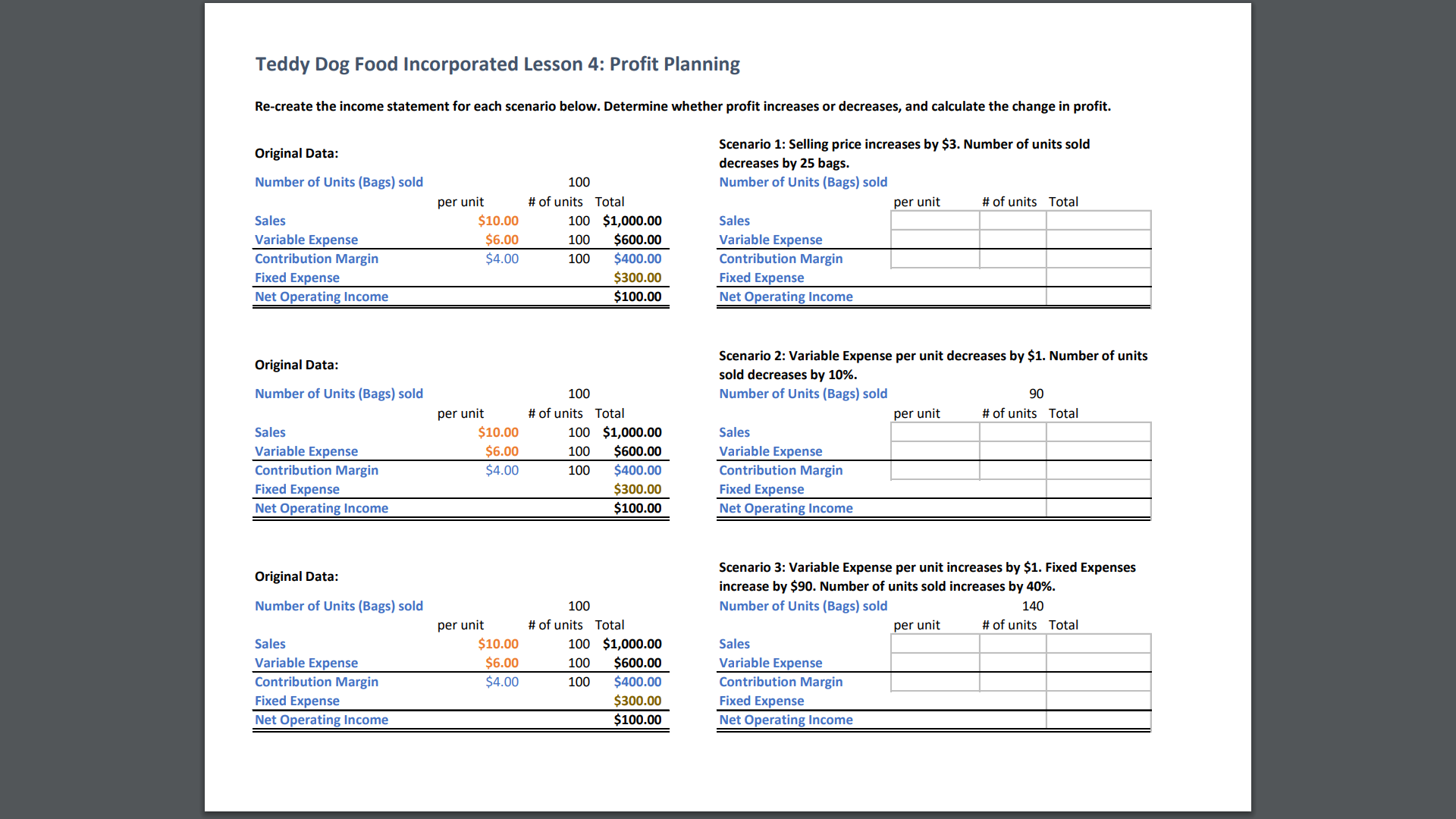

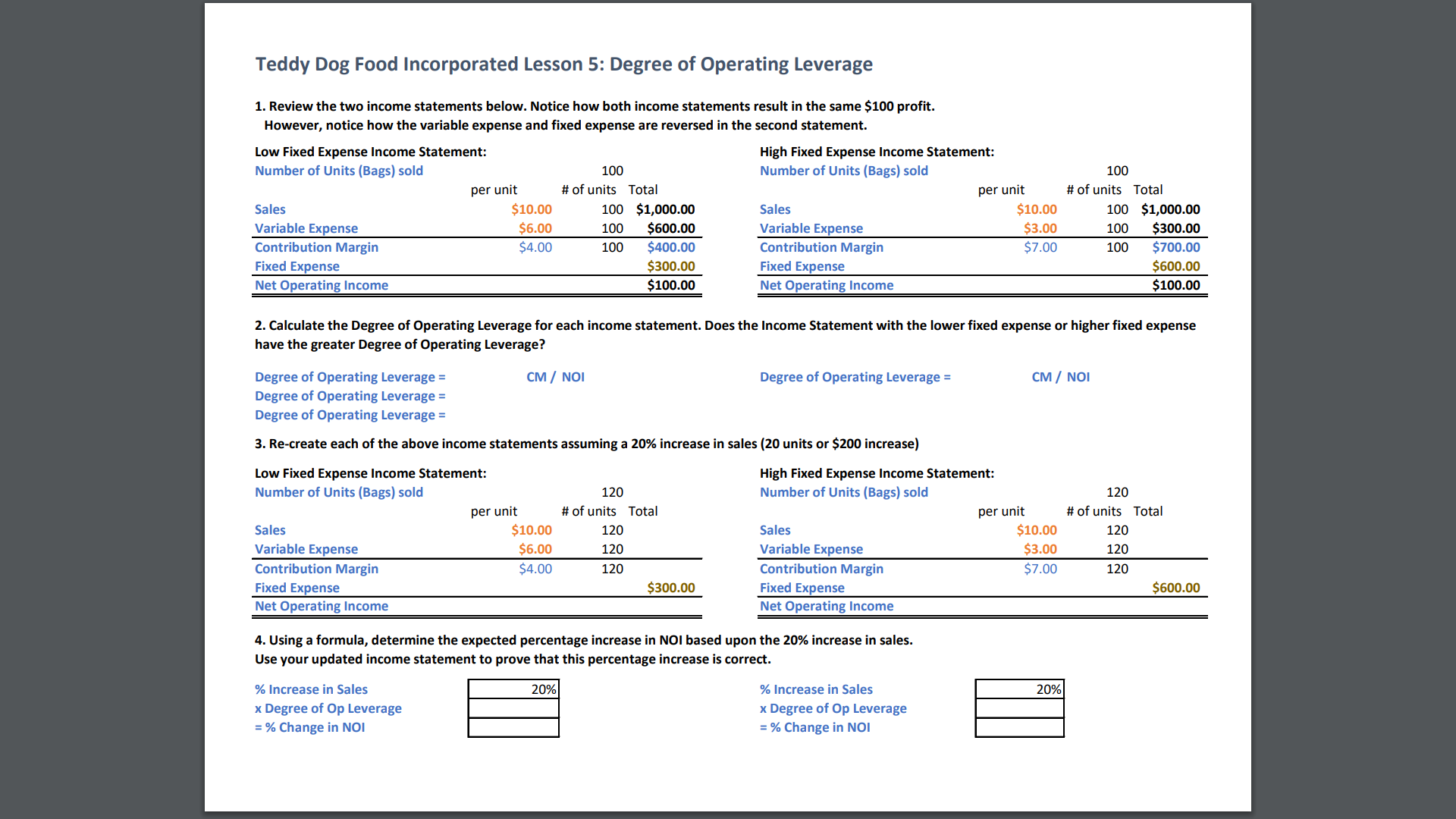

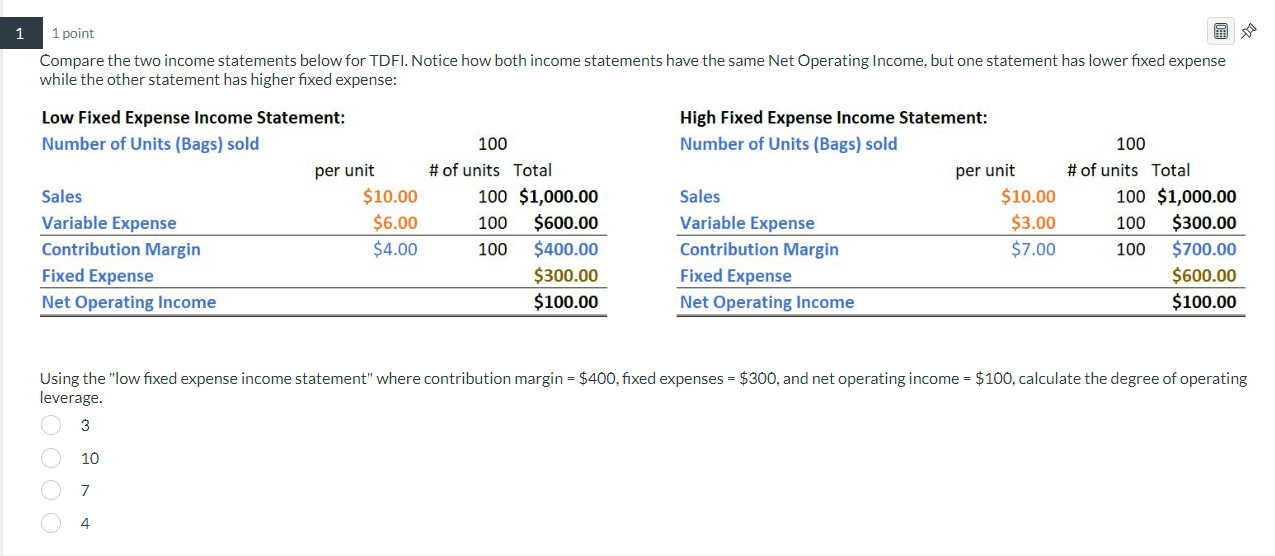

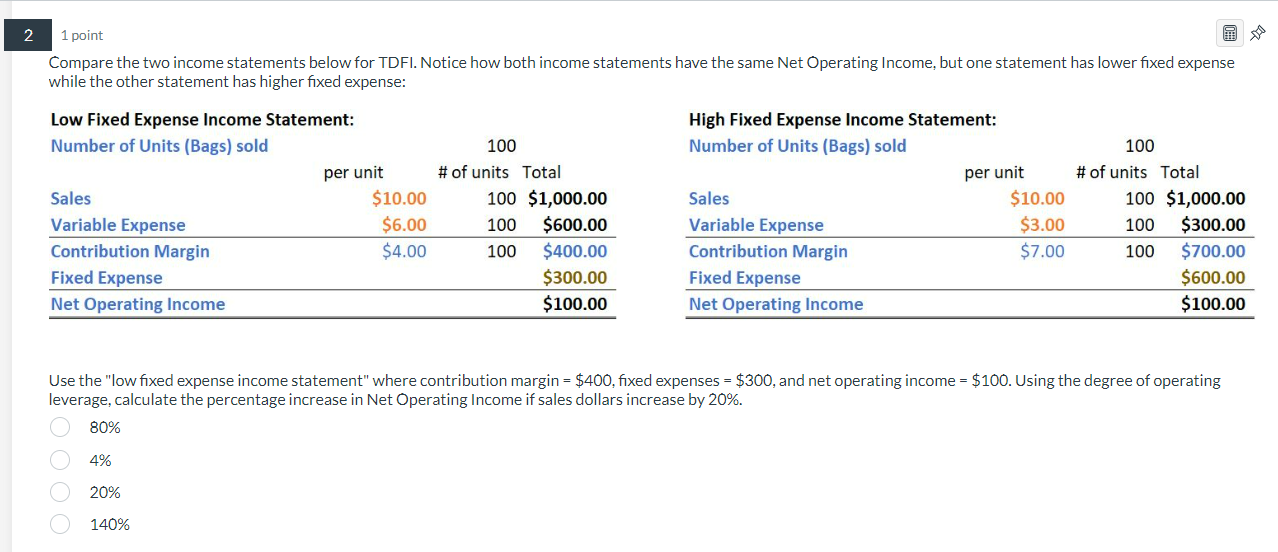

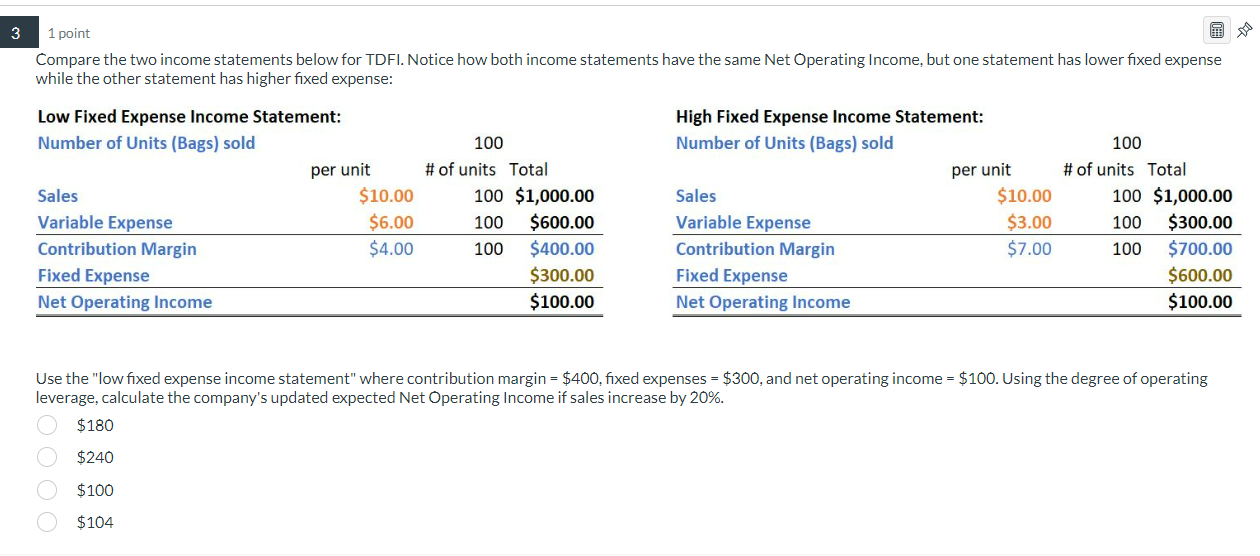

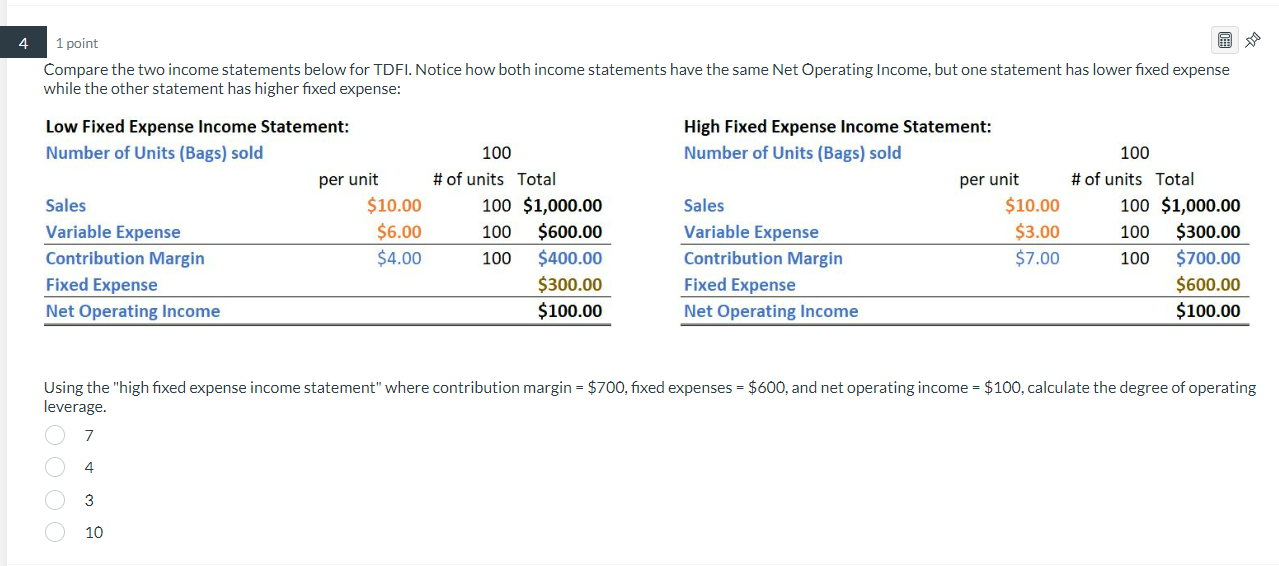

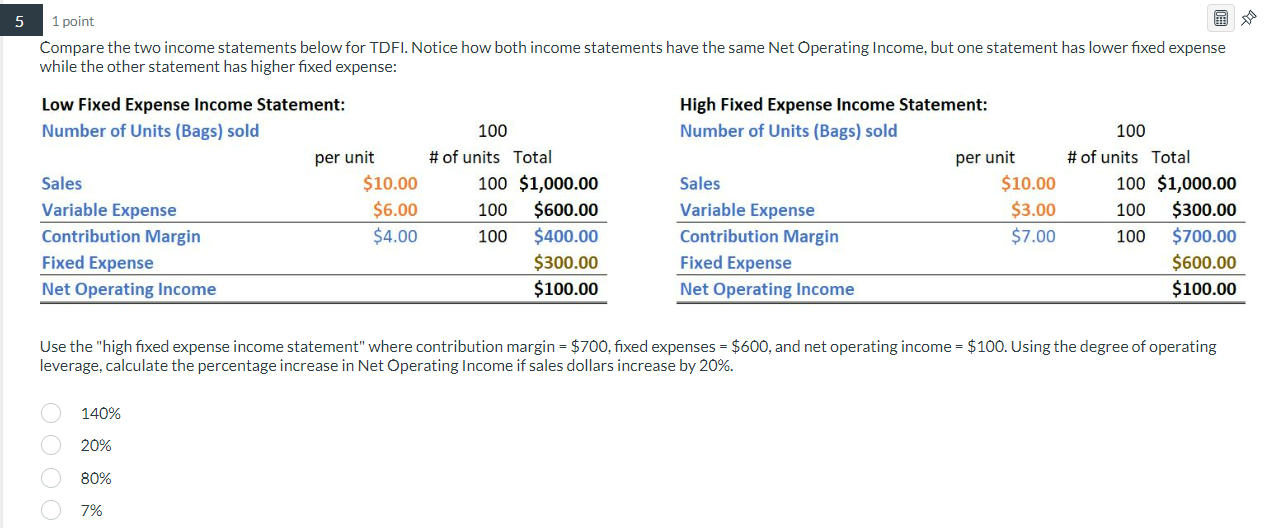

Contribution Margin $4.00 100 $400.00 Contribution Margin 7x 75 525 Fixed Expense $300.00 Fixed Expense 300 Net Operating Income $100.00 Net Operating Income +125 increase Original Data: Scenario 2: Variable Expense per unit decreases by $1. Number of units sold decreases by 10%. 100 x 1) = 10units Number of Units (Bags) sold 100 Number of Units (Bags) sold 90 100 - 10 per unit # of units Total per unit # of units Total Sales $10.00 100 $1,000.00 Sales 90 900 Variable Expense $6.00 100 $600.00 Variable Expense 90 450 Contribution Margin $4.00 100 $400.00 Contribution Margin 90 450 Fixed Expense $300.00 Fixed Expense 300 Net Operating Income $100.00 Net Operating Income 150 increase of $58 Original Data: Scenario 3: Variable Expense per unit increases by $1. Fixed Expenses increase by $90. Number of units sold increases by 40%. Number of Units (Bags) sold 100 Number of Units (Bags) sold 140 per unit # of units Total per unit # of units Total Sales $10.00 100 $1,000.00 Sales 1900 Variable Expense $6.00 100 $600.00 Variable Expense 140 Contribution Margin $4.00 100 $400.00 Contribution Margin 3 X 140 920 Fixed Expense $300.00 Fixed Expense 390 Net Operating Income $100.00 Net Operating Income decrease of #70 then you can take the 1400 minus 980, but don't do that.Teddy Dog Food Incorporated Lesson 5: Degree of Operating Leverage 1. Review the two income statements below. Notice how both income statements result in the same $100 profit. However, notice how the variable expense and fixed expense are reversed in the second statement Low Fixed Expense Income Statement: High Fixed Expense Income Statement: Number of Units (Bags) sold 100 Number of Units (Bags) sold 100 per unit # of units Total per unit # of units Total Sales $10.00 100 $1,000.00 Sales $10.00 100 $1,000.00 Variable Expense $6.00 100 $600.00 Variable Expense $3.00 100 $300.00 Contribution Margin $4.00 100 $400.00 Contribution Margin $7.00 100 $700.00 Fixed Expense $300.00 Fixed Expense $600.00 Net Operating Income $100.00 Net Operating Income $100.00 100 X 1. 4 = 140 2. Calculate the Degree of Operating Leverage for each income statement. Does the Income Statement with the lower fixed expense or higher fixed expense have the greater Degree of Operating Leverage? increase Degree of Operating Leverage = CM / NOI Degree of Operating Leverage = CM / NOI Degree of Operating Leverage = 400 / 100 700 / 100 2 Degree of Operating Leverage = 4 3. Re-create each of the above income statements assuming a 20% increase in sales (20 units or $200 increase) Low Fixed Expense Income Statement: High Fixed Expense Income Statement: Number of Units (Bags) sold 120 Number of Units (Bags) sold 120 per unit # of units Total per unit # of units Total Sales $10.00 120 1 200 Sales $10.00 120 1206 Variable Expense $6.0 120 720 Variable Expense $3.0 120 360 Contribution Margin $4.00 X 120 480 Contribution Margin $7.00 X 120 840 Fixed Expense $300.00 Fixed Expense - $600.00 Net Operating Income 180 Net Operating Income 240 4. Using a formula, determine the expected percentage increase in NOI based upon the 20% increase in sales. Use your updated income statement to prove that this percentage increase is correct. % Increase in Sales 20% % Increase in Sales 20% x Degree of Op Leverage x Degree of Op Leverage = % Change in NOI 80% = % Change in NOI 140 140 dollar increase.Teddy Dog Food Incorporated (TDFI) currently makes and sells one type and size of dog food. a 16 ounce bag of all-natural freeze-dried chicken. Use the following data as your starting point for each question on this quiz: . TDFI sells each bag of food for $10. - The Variable Expense per bag of food is $6. . Fixed Expenses per month total $300. - TDFI cu rrentiy sells 100 units of dog food. What is the Contribution Margin per unit For TDFI? $4 $10 $400 $1000 Teddy Dog Food Incorporated (TDFI) currently makes and sells one type and size of dog food. a 16 ounce bag of all-natural freeze-dried chicken. Use the following data as your starting point for each question on this quiz: 0 TDFI sells each bag of food for $10. - The Variable Expense per bag of food is $6. 0 Fixed Expenses per month total $300. - TDFI currently sells 100 units of dog food. IFTDFI were to raise its selling price by $3, what would be the new Contribution Margin per unit torTDFl? $525 $13 $7 $700 I)? 3 1 point Teddy Dog Food Incorporated (TDFI) currently makes and sells one type and size of dog food, a 16 ounce bag of all-natural freeze-dried chicken. Use the following data as your starting point for each question on this quiz: . TDFI sells each bag of food for $10. . The Variable Expense per bag of food is $6. Fixed Expenses per month total $300. TDFI currently sells 100 units of dog food. If TDFI were to increase its variable cost per unit by $1, what would be the new Contribution Margin per unit for TDFI? O $7 $300 $3 $5 4 1 point Teddy Dog Food Incorporated (TDFI) currently makes and sells one type and size of dog food, a 16 ounce bag of all-natural freeze-dried chicken. Use the following data as your starting point for each question on this quiz: . TDFI sells each bag of food for $10. . The Variable Expense per bag of food is $6. . Fixed Expenses per month total $300 . TDFI currently sells 100 units of dog food. If TDFI were to increase its variable expense per unit by $1, increase its fixed expenses by $90, and increase the number of units sold by 40%, what would be the new Contribution Margin for TDFI? O $1400 $30 OO $800 O $4205 1 point Teddy Dog Food Incorporated (TDFI) currently makes and sells one type and size of dog food, a 16 ounce bag of all-natural freeze-dried chicken. Use the following data as your starting point for each question on this quiz: . TDFI sells each bag of food for $10. . The Variable Expense per bag of food is $6. Fixed Expenses per month total $300 . TDFI currently sells 100 units of dog food. If TDFI were to increase its variable expense per unit by $1, increase its fixed expenses by $90, and increase the number of units sold by 40%, what would be the new Net Operating Income for TDFI? $800 $1400 OOOO $420 $30Teddy Dog Food Incorporated Lesson 4: Profit Planning Re-create the income statement for each scenario below. Determine whether profit increases or decreases, and calculate the change in profit Original Data: Number of Units [Bags] sold Sales Variable Expense Contribution Margin Fixed Expense Net Operating Income 100 per unit III of units Total $10.00 100 $1,000.00 $5.00 100 $600.00 $4.00 100 $400.00 $300.00 $100.00 Scenario 1: Selling price increases by 53. Number 0' units sold decreases by 25 bags. Number of Units (Bags) sold per unit 3 of units Total Sales Variable Expense Contribution Margin Fixed Expense Net Operating Income Original Data: Number of Units [Bags] sold Sales Variable Expense Contribution Margin Fixed Expense 100 per unit 3 of units Total $10.00 100 $1,000.00 $6.00 100 $600.00 $4.00 100 $400.00 $300.00 Scenario 2: Variable Expense per unit decreases by $1. Number of units sold decreases by 10%. Number of Units (Bags) sold 90 per unit it of units Total Sales Variable Expense Contribution Margin Fixed Expense Net Operating Income $100.00 Net Operating Income Original Data: Number of Units [Bags] sold Sales Variable Expense Contribution Margin Fixed Expense Net Operating Income 100 per unit R of units Total $10.00 100 $1,000.00 $6.00 100 $500.00 $4.00 100 $400.00 $300.00 $100.00 Scenario 3: Variable Expense per unit increases by 51. Fixed Expenses increase by 550. Number of units sold increases by 40%. Number of Units (Bags) sold 140 per unit a of units Total Sales Variable Expense Contribution Margin Fixed Expense Net Operating Income Teddy Dog Food Incorporated Lesson 5: Degree of Operating Leverage 1. Review the two income statements below. Notice how both income statements result in the same 5100 prolit. However, notice how the variable expense and lixed expense are reversed in the second statement. low Fixed Expense Income Statement: Number of Units [Bags] sold 100 per unit it of units Total Sales $10.00 100 $1,000.00 Variable Expense $6.00 100 $600.00 High Fixed Expense Income Statement: Number of Units {Bags} sold 100 per unit Iiof units Total Sales $10.00 100 51,00000 Variable Expense $3.00 100 $30000 Contribution Margin $4.00 100 $400.00 Fixed Expense $300.00 Net Operating Income $100.00 Contribution Margin $7.00 100 $700.00 Fixed Expense $600.00 Net Operating Income $100.00 2. Calculate the Degree of Operating Leverage {or each income statement. Does the Income Statement with the lower tixed expense or higher fixed expense have the greater Degree of Operating Leverage? Degree of Operating Leverage : CM / NOI Degree of Operating Leverage : Degree of Operating Leverage : Degree of Operating Leverage : CM/ NDI 3. Re-create each of the above income statements assuming a 10% increase in sales (20 units or $200 increase] Low Fixed Expense Income Statement: Number of Units [Bags] sold 120 per unit it of units Total Sales $10.00 120 Variable Expense $6.00 120 Contribution Margin $4.00 120 Fixed Expense $300.00 Net Operating Income High Fixed Expense Income Statement: Number of Units {Bags} sold 120 per unit H of units Total Sales $10.00 120 Variable Expense $3.00 1.20 Contribution Margin $7.00 120 Fixed Expense $600.00 Net Operating Income 4. Using a formula, determine the expected percentage increase in MOI based upon the 20% increase in sales. Use your updated income statement to prove that this percentage increase is correct. % Increase in Sales 20% x Degree of Op Leverage :94. Change in NOI % Increase in Sales x Degree 0! Op Leverage : % Change in NOI 1 1 point Compare the two income statements below for TDFI. Notice how both income statements have the same Net Operating Income, but one statement has lower fixed expense while the other statement has higher fixed expense: Low Fixed Expense Income Statement: High Fixed Expense Income Statement: Number of Units (Bags) sold 100 Number of Units (Bags) sold 100 per unit # of units Total per unit # of units Total Sales $10.00 100 $1,000.00 Sales $10.00 100 $1,000.00 Variable Expense $6.00 100 $600.00 Variable Expense $3.00 100 $300.00 Contribution Margin $4.00 100 $400.00 Contribution Margin $7.00 100 $700.00 Fixed Expense $300.00 Fixed Expense $600.00 Net Operating Income $100.00 Net Operating Income $100.00 Using the "low fixed expense income statement" where contribution margin = $400, fixed expenses = $300, and net operating income = $100, calculate the degree of operating leverage. 3 10 7 O 42 1 point Compare the two income statements below for TDFI. Notice how both income statements have the same Net Operating Income, but one statement has lower fixed expense while the other statement has higher fixed expense: Low Fixed Expense Income Statement: High Fixed Expense Income Statement: Number of Units (Bags) sold 100 Number of Units (Bags) sold 100 per unit # of units Total per unit # of units Total Sales $10.00 100 $1,000.00 Sales $10.00 100 $1,000.00 Variable Expense $6.00 100 $600.00 Variable Expense $3.00 100 $300.00 Contribution Margin $4.00 100 $400.00 Contribution Margin $7.00 100 $700.00 Fixed Expense $300.00 Fixed Expense $600.00 Net Operating Income $100.00 Net Operating Income $100.00 Use the "low fixed expense income statement" where contribution margin = $400, fixed expenses = $300, and net operating income = $100. Using the degree of operating leverage, calculate the percentage increase in Net Operating Income if sales dollars increase by 20%. O 80% 4% O 20% O 140%3 1 point Compare the two income statements below for TDFI. Notice how both income statements have the same Net Operating Income, but one statement has lower fixed expense while the other statement has higher fixed expense: Low Fixed Expense Income Statement: High Fixed Expense Income Statement: Number of Units (Bags) sold 100 Number of Units (Bags) sold 100 per unit # of units Total per unit # of units Total Sales $10.00 100 $1,000.00 Sales $10.00 100 $1,000.00 Variable Expense $6.00 100 $600.00 Variable Expense $3.00 100 $300.00 Contribution Margin $4.00 100 $400.00 Contribution Margin $7.00 100 $700.00 Fixed Expense $300.00 Fixed Expense $600.00 Net Operating Income $100.00 Net Operating Income $100.00 Use the "low fixed expense income statement" where contribution margin = $400, fixed expenses = $300, and net operating income = $100. Using the degree of operating leverage, calculate the company's updated expected Net Operating Income if sales increase by 20%. O $180 O $240 O $100 O $1044 1 point Compare the two income statements below for TDFI. Notice how both income statements have the same Net Operating Income, but one statement has lower fixed expense while the other statement has higher fixed expense: Low Fixed Expense Income Statement: High Fixed Expense Income Statement: Number of Units (Bags) sold 100 Number of Units (Bags) sold 100 per unit # of units Total per unit # of units Total Sales $10.00 100 $1,000.00 Sales $10.00 100 $1,000.00 Variable Expense $6.00 100 $600.00 Variable Expense $3.00 100 $300.00 Contribution Margin $4.00 100 $400.00 Contribution Margin $7.00 100 $700.00 Fixed Expense $300.00 Fixed Expense $600.00 Net Operating Income $100.00 Net Operating Income $100.00 Using the "high fixed expense income statement" where contribution margin = $700, fixed expenses = $600, and net operating income = $100, calculate the degree of operating leverage. O 7 4 3 O 105 1 point Compare the two income statements below for TDFI. Notice how both income statements have the same Net Operating Income, but one statement has lower fixed expense while the other statement has higher fixed expense: Low Fixed Expense Income Statement: High Fixed Expense Income Statement: Number of Units (Bags) sold 100 Number of Units (Bags) sold 100 per unit # of units Total per unit # of units Total Sales $10.00 100 $1,000.00 Sales $10.00 100 $1,000.00 Variable Expense $6.00 100 $600.00 Variable Expense $3.00 100 $300.00 Contribution Margin $4.00 100 $400.00 Contribution Margin $7.00 100 $700.00 Fixed Expense $300.00 Fixed Expense $600.00 Net Operating Income $100.00 Net Operating Income $100.00 Use the "high fixed expense income statement" where contribution margin = $700, fixed expenses = $600, and net operating income = $100. Using the degree of operating leverage, calculate the percentage increase in Net Operating Income if sales dollars increase by 20%. O 140% O 20% O 80% O 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts