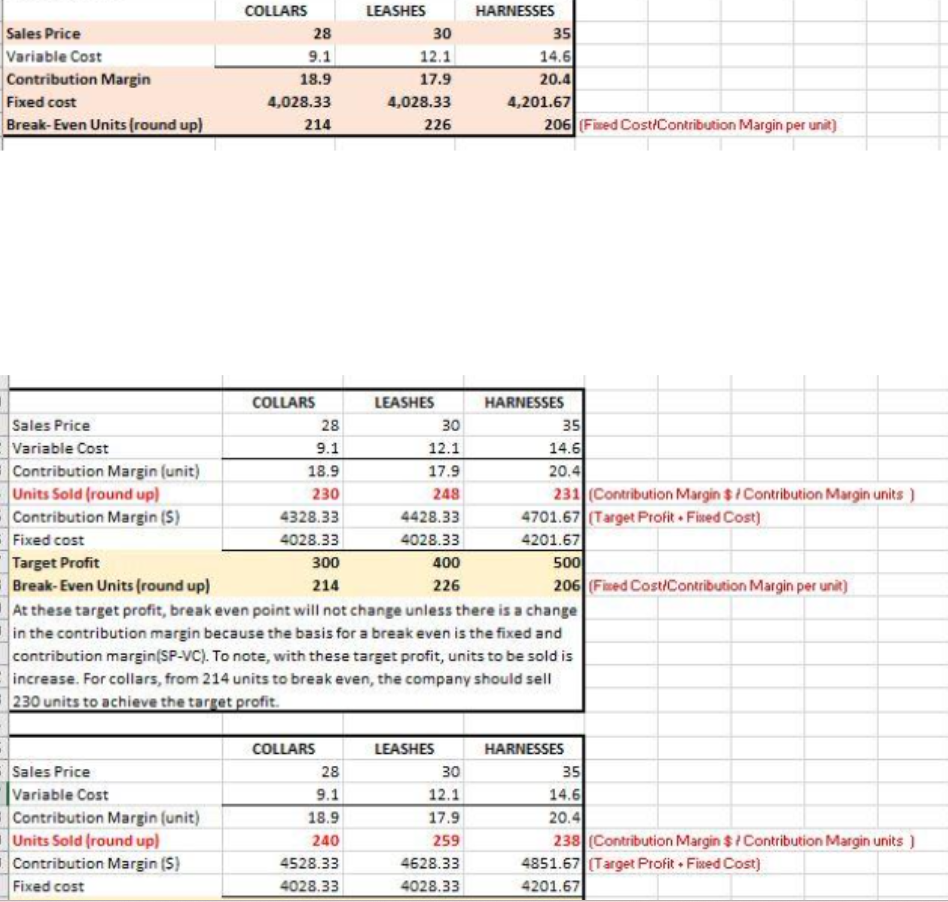

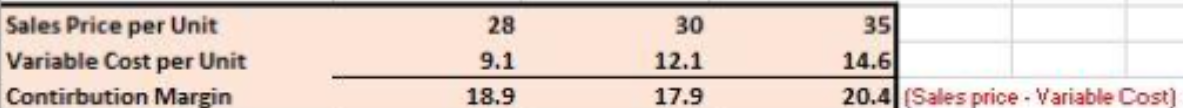

Question: Contribution Margin COLLARS LEASHES HARNESSES Sales Price 28 30 35 Variable Cost 9.1 12.1 14.6 Contribution Margin 18.9 17.9 20.4 Fixed cost 4,028.33 4,028.33 4,201.67

Contribution Margin

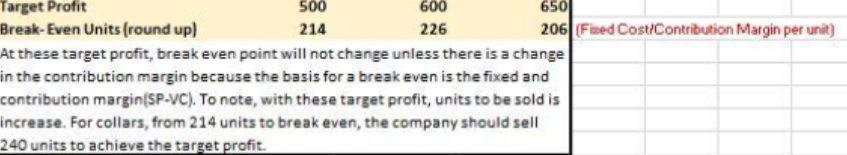

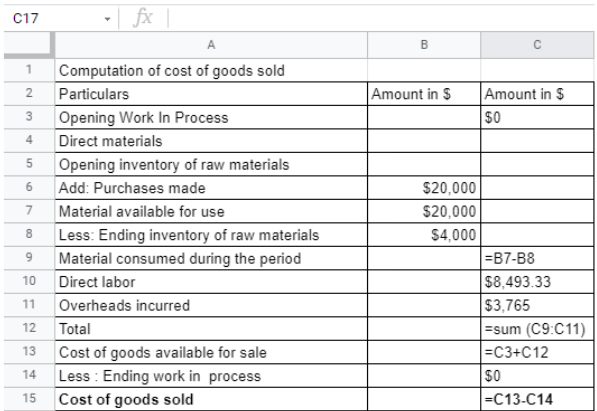

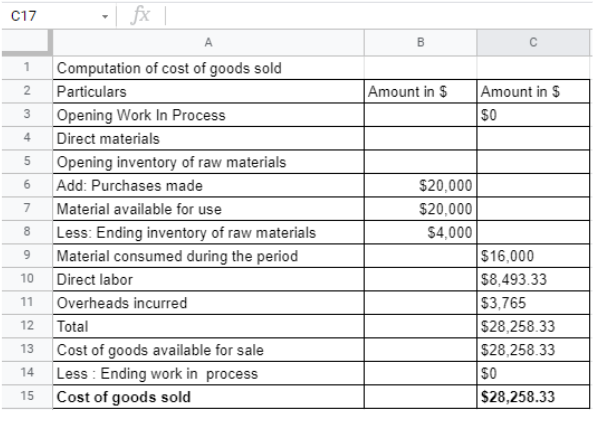

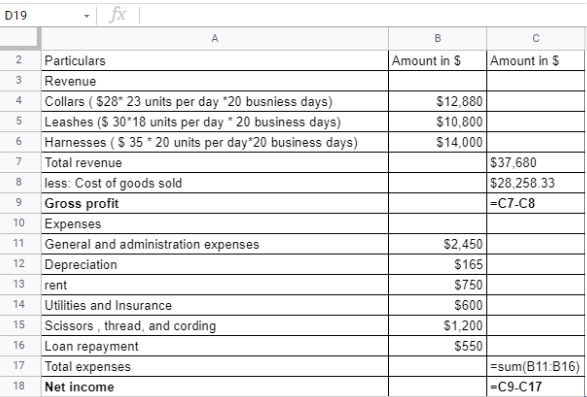

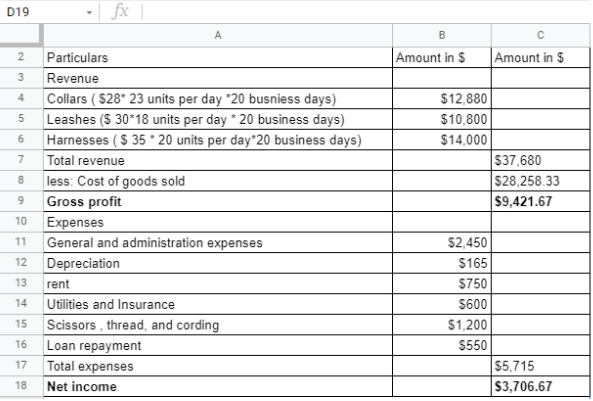

COLLARS LEASHES HARNESSES Sales Price 28 30 35 Variable Cost 9.1 12.1 14.6 Contribution Margin 18.9 17.9 20.4 Fixed cost 4,028.33 4,028.33 4,201.67 Break-Even Units (round up) 214 226 206 (Fixed Cost/Contribution Margin per unit) COLLARS LEASHES HARNESSES Sales Price 28 30 35 Variable Cost 9.1 12.1 14.6 Contribution Margin (unit) 18.9 17.9 20.4 Units Sold (round up) 230 248 231 (Contribution Margin $ / Contribution Margin units ) Contribution Margin (S) 4328.33 4428.33 4701.67 (Target Profit . Fixed Cost) Fixed cost 4028.33 4028.33 4201.67 Target Profit 300 400 500 Break-Even Units (round up) 214 226 206 (Fixed Cost/Contribution Margin per unit) At these target profit, break even point will not change unless there is a change in the contribution margin because the basis for a break even is the fixed and contribution margin(SP-VC). To note, with these target profit, units to be sold is increase. For collars, from 214 units to break even, the company should sell 230 units to achieve the target profit. COLLARS LEASHES HARNESSES Sales Price 28 30 35 Variable Cost 9.1 12.1 14.6 Contribution Margin (unit) 18.9 17.9 20.4 Units Sold (round up) 240 259 238 (Contribution Margin $ / Contribution Margin units ) Contribution Margin (S) 4528.33 4628.33 4851.67 (Target Profit . Fixed Cost) Fixed cost 4028.33 4028.33 4201.67Target Profit 500 600 650 Break-Even Units (round up) 214 226 206 [Fixed Cost/Contribution Margin per unit) At these target profit, break even point will not change unless there is a change in the contribution margin because the basis for a break even is the fixed and contribution margin(SP-VC). To note, with these target profit, units to be sold is increase. For collars, from 214 units to break even, the company should sell 240 units to achieve the target profit.C17 fx | A B C Computation of cost of goods sold 2 Particulars Amount in $ Amount in $ 3 Opening Work In Process $0 4 Direct materials Opening inventory of raw materials 6 Add: Purchases made $20,000 7 Material available for use $20,000 8 Less: Ending inventory of raw materials $4,000 Material consumed during the period =B7-B8 10 Direct labor $8,493.33 11 Overheads incurred $3,765 12 Total =sum (C9:011) 13 Cost of goods available for sale =C3+C12 14 Less : Ending work in process $0 15 Cost of goods sold =C13-C14c17 sl W N A A Computation of cost of goods sold Particulars Opening Work In Process Direct materials Opening inventory of raw materials Amount in Amountin $ Add: Purchases made Material available for use Less: Ending inventory of raw materials Material consumed during the period $20,000 $20,000 54,00 o $16,000 Direct labor Overheads incurred Total Cost of goods available for sale $8,493.33 3,765 28,258.33 $28,258.33 A I Less : Ending work in process Cost of goods sold w3 o $28,258.33 \fD19 s =l | & | | = W Particulars B c Amount in $ Amount in $ Revenue Collars { 28" 23 units per day 20 busniess days) Leashes ($ 30"18 units per day * 20 business days) Harnesses (5 35 20 units per day*20 business days) Total revenue S| | stosoe| | swooe| | less: Cost of goods sold Gross profit Expenses $37.680 $28,258.33 o General and administration expenses Depreciation rent Utilities and Insurance Scissors , thread, and cording Loan repayment Total expenses Net income | |=sum(B11:B16) =C9.C17 D19 fx A B C 2 Particulars Amount in $ Amount in $ 3 Revenue 4 Collars ( $28* 23 units per day *20 busniess days) $12,880 5 Leashes ($ 30*18 units per day * 20 business days) $10,800 6 Harnesses ( $ 35 * 20 units per day*20 business days) $14,000 7 Total revenue 537,680 8 less: Cost of goods sold $28,258.33 9 Gross profit $9,421.67 10 Expenses 11 General and administration expenses $2,450 12 Depreciation $165 13 rent $750 14 Utilities and Insurance $600 15 Scissors , thread, and cording $1,200 16 Loan repayment $550 17 Total expenses $5,715 18 Net income $3,706.67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts