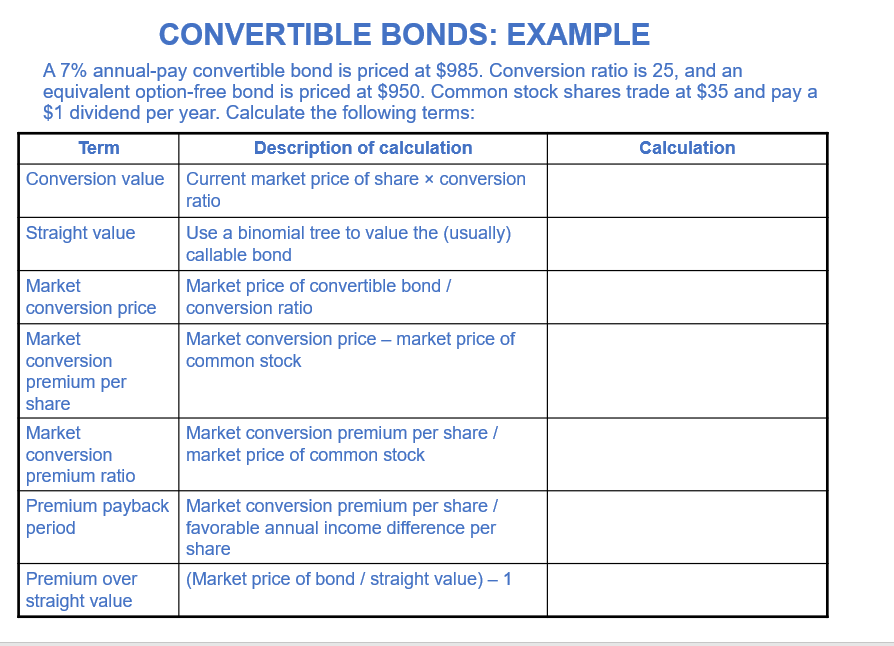

Question: CONVERTIBLE BONDS: EXAMPLE A 7% annual-pay convertible bond is priced at $985. Conversion ratio is 25, and an equivalent option-free bond is priced at $950.

CONVERTIBLE BONDS: EXAMPLE A 7% annual-pay convertible bond is priced at $985. Conversion ratio is 25, and an equivalent option-free bond is priced at $950. Common stock shares trade at $35 and pay a $1 dividend per year. Calculate the following terms: Calculation Term Conversion value Description of calculation Current market price of share x conversion ratio Straight value Use a binomial tree to value the (usually) callable bond Market Market price of convertible bond / conversion price conversion ratio Market Market conversion price - market price of conversion common stock premium per share Market Market conversion premium per share / conversion market price of common stock premium ratio Premium payback Market conversion premium per share/ period favorable annual income difference per share Premium over (Market price of bond / straight value) - 1 straight value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts