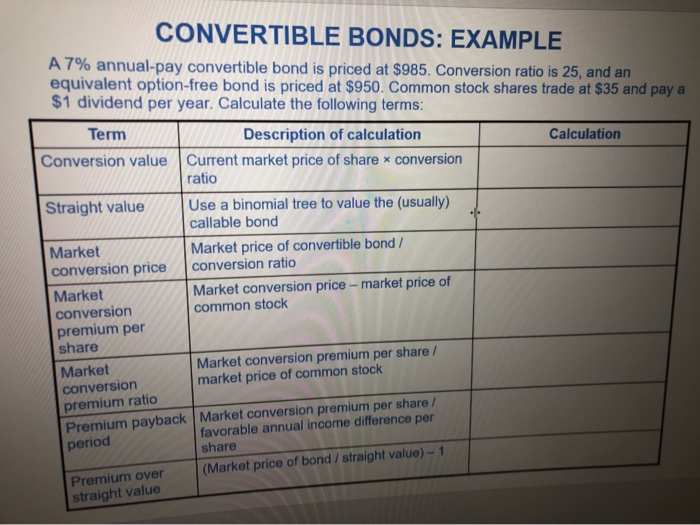

Question: mainly: Binomial tree CONVERTIBLE BONDS: EXAMPLE A 7% annual-pay convertible bond is priced at $985. Conversion ratio is 25, and an equivalent option-free bond is

CONVERTIBLE BONDS: EXAMPLE A 7% annual-pay convertible bond is priced at $985. Conversion ratio is 25, and an equivalent option-free bond is priced at $950. Common stock shares trade at $35 and pay a $1 dividend per year. Calculate the following terms: Term Description of calculation Calculation Conversion value Current market price of share * conversion ratio Straight value Use a binomial tree to value the (usually) callable bond Market Market price of convertible bond / conversion price conversion ratio Market Market conversion price - market price of conversion common stock premium per share Market Market conversion premium per share / conversion market price of common stock premium ratio Premium payback Market conversion premium per share favorable annual income difference per period share (Market price of bond / straight value) - 1 Premium over straight value CONVERTIBLE BONDS: EXAMPLE A 7% annual-pay convertible bond is priced at $985. Conversion ratio is 25, and an equivalent option-free bond is priced at $950. Common stock shares trade at $35 and pay a $1 dividend per year. Calculate the following terms: Term Description of calculation Calculation Conversion value Current market price of share * conversion ratio Straight value Use a binomial tree to value the (usually) callable bond Market Market price of convertible bond / conversion price conversion ratio Market Market conversion price - market price of conversion common stock premium per share Market Market conversion premium per share / conversion market price of common stock premium ratio Premium payback Market conversion premium per share favorable annual income difference per period share (Market price of bond / straight value) - 1 Premium over straight value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts