Question: Coones Classes Activity for Net PX NET PRESENT VA X FQGQ36jEAtahqu-qbdK52145gep/view The value of each cash flow needs to be adjusted for risk and the

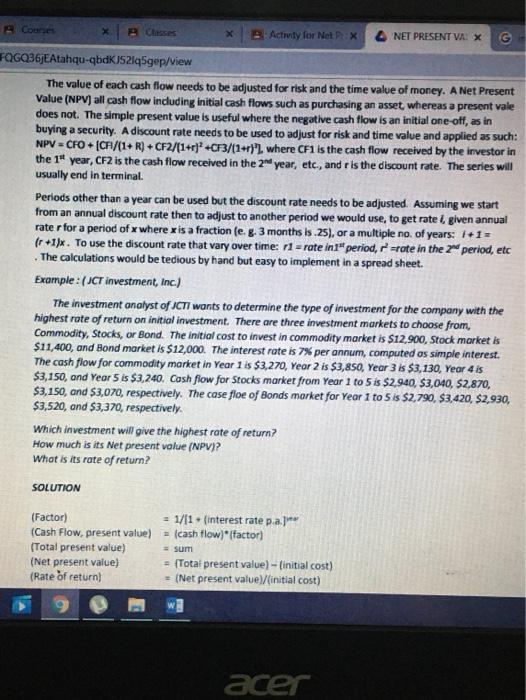

Coones Classes Activity for Net PX NET PRESENT VA X FQGQ36jEAtahqu-qbdK52145gep/view The value of each cash flow needs to be adjusted for risk and the time value of money. A Net Present Value (NPV) all cash flow including initial cash flows such as purchasing an asset, whereas a present vale does not. The simple present value is useful where the negative cash flow is an initial one-off, as in buying a security. A discount rate needs to be used to adjust for risk and time value and applied as such: NPV - CFO + [CF/(1+R) + CF2/(1+r) +CF3/(1+r)"), where CF1 is the cash flow received by the investor in the 1" year, CF2 is the cash flow received in the 2nd year, etc., and is the discount rate. The series will usually end in terminal Periods other than a year can be used but the discount rate needs to be adjusted. Assuming we start from an annual discount rate then to adjust to another period we would use, to get rate is given annual rater for a period of x where x is a fraction (e. g. 3 months is.25), or a multiple no. of years: 1+1= (r +1)x. To use the discount rate that vary over time: 11 = rate int" period, P =rate in the 2nd period, etc The calculations would be tedious by hand but easy to implement in a spread sheet. Example: (JCT investment, Inc.) The investment analyst of JCTI wants to determine the type of investment for the company with the highest rate of return on initial investment. There are three investment markets to choose from, Commodity, Stocks, or Bond. The initial cost to invest in commodity market is $12.900, Stock market is $11,400, and Bond market is $12,000. The interest rate is 7% per annum, computed as simple interest. The cash flow for commodity market in Year 1 is $3,270, Year 2 is $3,850, Year 3 is $3,130, Year 4 is $3,150, and Year 5 is $3,240. Cash flow for Stocks market from Year 1 to 5 is $2,940, $3,040, 52,870, $3,150, and $3,070, respectively. The case floe of Bonds market for Year 1 to 5 is $2,790, $3,420, $2,930, $3,520, and $3,370, respectively. Which investment will give the highest rate of return? How much is its Net present value (NPV)? What is its rate of return? SOLUTION (Factor) (Cash Flow, present value) (Total present value) (Net present value) (Rate of return = 1/11. (interest rate p.a." = (cash flow)"(factor = Total present value) - initial cost) (Net present value)/(initial cost) sum acer