Question: Cooper and Dane exchanged properties with each other. Cooper exchanged a commercial building and land with a basis of $200,000 and a fair market

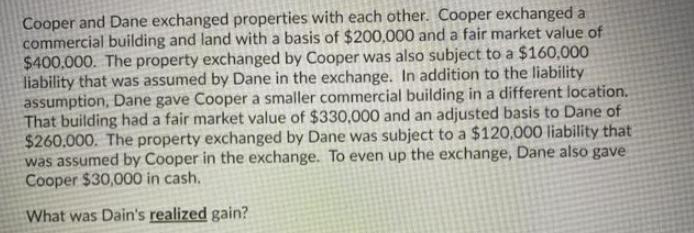

Cooper and Dane exchanged properties with each other. Cooper exchanged a commercial building and land with a basis of $200,000 and a fair market value of $400,000. The property exchanged by Cooper was also subject to a $160,000 liability that was assumed by Dane in the exchange. In addition to the liability assumption, Dane gave Cooper a smaller commercial building in a different location. That building had a fair market value of $330,000 and an adjusted basis to Dane of $260.000. The property exchanged by Dane was subject to a $120,000 liability that was assumed by Cooper in the exchange. To even up the exchange, Dane also gave Cooper $30,000 in cash, What was Dain's realized gain?

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

SOLUTION FAIR VALUE OF BUILDING ... View full answer

Get step-by-step solutions from verified subject matter experts