Question: Cornerstone Exercise 3-19 (Algorithmic) Deferred Revenue Adjusting Entries Olney Cleaning Company had the following items that require adjustment at year end. a. For one cleaning

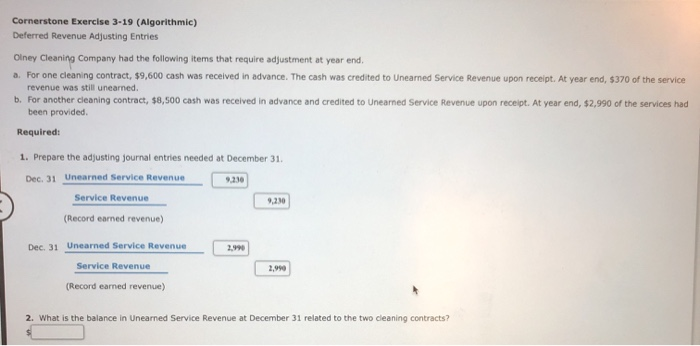

Cornerstone Exercise 3-19 (Algorithmic) Deferred Revenue Adjusting Entries Olney Cleaning Company had the following items that require adjustment at year end. a. For one cleaning contract, $9,600 cash was received in advance. The cash was credited to Uneared Service Revenue upon receipt. At year end, $370 of the service revenue was still unearned. b. For another cleaning contract, $8,500 cash was received in advance and credited to Unearned Service Revenue upon receipt. At year end, $2,990 of the services had been provided Required: 1. Prepare the adjusting journal entries needed at December 31. Dec. 31 Unearned Service Revenue 9.230 Service Revenue 9.230 (Record earned revenue) Dec. 31 Unearned Service Revenue Service Revenue (Record earned revenue) 2. What is the balance in Uneared Service Revenue at December 31 related to the two cleaning contracts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts