Question: cornerstone exercise 8-26 Cornerstone Exercise 8-26 (Algorithmic) Payroll Taxes Hernandez Builders has a gross payroll for January amounting to $460,000. The following amounts have been

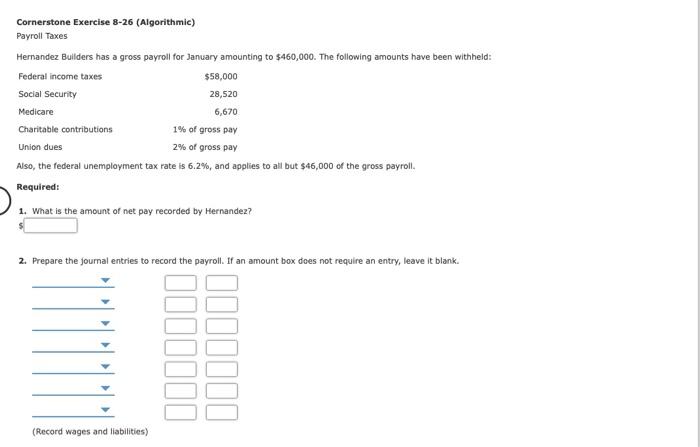

Cornerstone Exercise 8-26 (Algorithmic) Payroll Taxes Hernandez Builders has a gross payroll for January amounting to $460,000. The following amounts have been withheld: Federal income taxes $58,000 Social Security 28,520 Medicare 6,670 Charitable contributions 1% of gross pay Union dues 2% of gross pay Also, the federal unemployment tax rate is 6.2%, and applies to all but $46,000 of the gross payroll. Required: 1. What is the amount of net pay recorded by Hernandez? 2. Prepare the journal entries to record the payroll. If an amount box does not require an entry, leave it blank. 11 (Record wages and liabilities) llllll (Record employer payroll taxes)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts