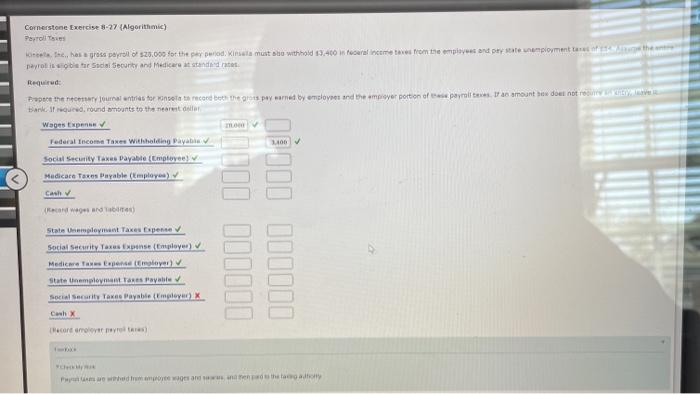

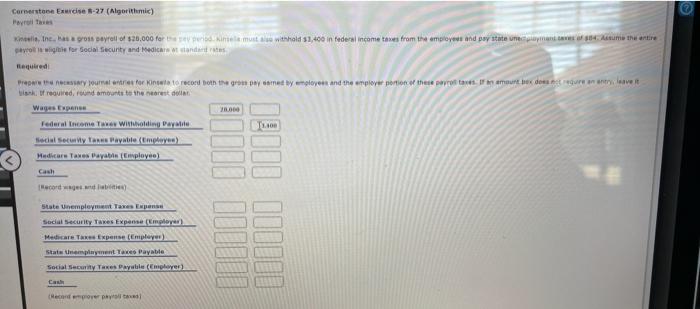

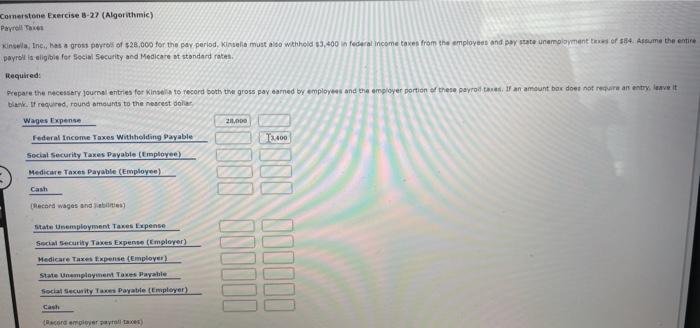

Question: Cornerstone Exercise 8-27 (Algorithmic) Peyroll for the has gross payroll of 528.000 for the pay period. Kinsel must so withhold 3.400 is oral income taxe

Cornerstone Exercise 8-27 (Algorithmic) Peyroll for the has gross payroll of 528.000 for the pay period. Kinsel must so withhold 3.400 is oral income taxe from the employees and pay state employment to the payroll in lobor Social Security and Medicare standart Dropce the courants for not a record but the gross paysamed by employees and the per portion of payroll an amount sodolno tank. It red, round amounts to the nearest Wages Expense Federal Income Taxes Withholding Payable 1100 Social Security Taxes Payable Employee Mudicate Taxes Puyable (Employee Cash biddin DODGO State Unemployment Taxes Expense Social Security Taxes e Employer) Medica prema State Unemployment as payable Social Security Texts Payable {mploye) X CalX IH.core rover neyrotres where we are the Cornerstone Exercise -27 (Algorithmic) het, Inc.grous payroll of $20,000 forintele must also withhold 51,400 in federal income taxes from the employees and pay statement 4. Ama entire care with for Social Security and Medicare it stands required Free Surnames for in to record both the group comedy players and the employer portion of these parts of texture antaveit Wakif required round amount to the nearest Federal Income Tax Winding Payali Modal Securvy fans Payable (Employee) Medicare Taxes Payabin Cowplayio) Cash Hecorded) bil!! DUD Jubill IIIII State Unemployment Taxes Expanse Social Security Taxes Expense (Employer) Medicare Taxed Expense Employee State temployment Taxes Payable Social Security Tees Payable (Employer) Cal (endore pays Cornerstone Exercise 8-27 (Algorithmic) Payroll Taxes Kinila, Inc., has a gross payroll of $20,000 for the pay period. Kinsel must also withhold 13,400 in federal income taxes from the employees and pay state unemployment is of 584 Assume the entire payrollis eligible for Social Security and Medicarest standard rates Required: Prepare the necessary Journal entries for kinse to record both the gross pay earned by employees and the employer portion of these payroll If an amount box does not require an entry leave it blan. It required, round amounts to the nearest dollar Wages Expense 200.000 Federal Income Taxes Withholding Payable Tx.400 Social Security Taxes Payable (Employee Medicare Taxes Payable (Employee) Cash (Record wages and bits) BOHINO JIUNE Quodol BONGO State Unemployment Takes Expense Social Security Taxes Expense (Employer) Medicare Taxes pense (Employer) State Unemployment Taxes Payabile Social Security Taxes Payable Employer Cash Recorderployer payroll taxes)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts