Question: Corning issued a zero - coupon convertible bond at ( $ 7 4 1 . 9 2 ) per (

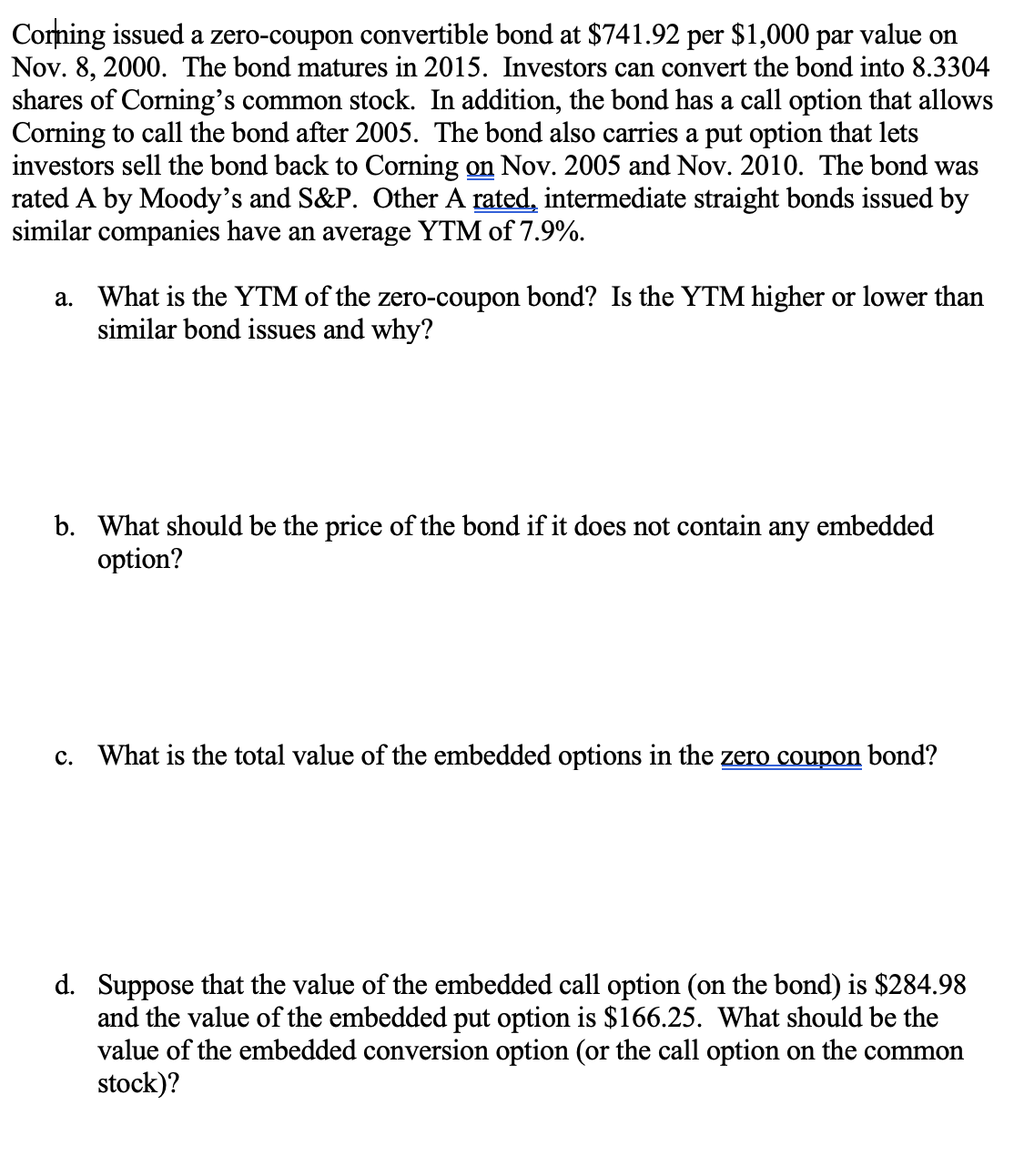

Corning issued a zerocoupon convertible bond at $ per $ par value on Nov. The bond matures in Investors can convert the bond into shares of Corning's common stock. In addition, the bond has a call option that allows Corning to call the bond after The bond also carries a put option that lets investors sell the bond back to Corning on Nov. and Nov. The bond was rated A by Moody's and S&P Other A rated, intermediate straight bonds issued by similar companies have an average YTM of a What is the YTM of the zerocoupon bond? Is the YTM higher or lower than similar bond issues and why? b What should be the price of the bond if it does not contain any embedded option? c What is the total value of the embedded options in the zero coupon bond? d Suppose that the value of the embedded call option on the bond is $ and the value of the embedded put option is $ What should be the value of the embedded conversion option or the call option on the common stock

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock