Question: Corporate Finance 11E, chapter 5 problem 26. Looking for a detailed solution for this problem by hand. And how to solve it on the Texas

Corporate Finance 11E, chapter 5 problem 26. Looking for a detailed solution for this problem by hand. And how to solve it on the Texas Instrument BAII Plus. Using growing perpetuity formula I am confused on how to compute 'g' on the calculator. Thanks

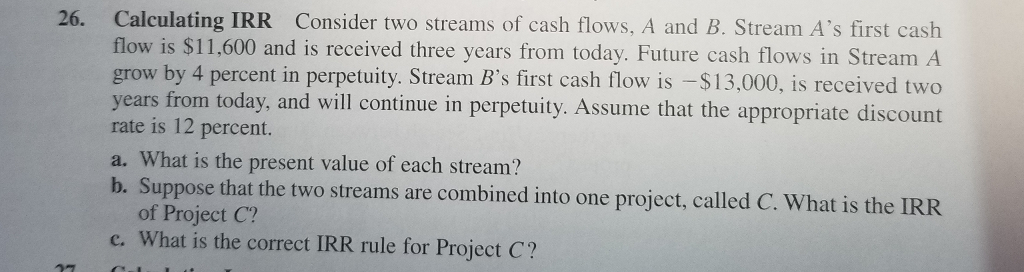

Consider two streams of cash flows, A and B. Stream A's first cash Calculating IRR flow is $11,600 and is received three years from today. Future cash flows in Stream A grow by 4 percent in perpetuity. Stream B's first cash flow is -$13,000, is received two years from today, and will continue in perpetuity. Assume that the appropriate dis rate is 12 percent. a. What is the present value of each stream? b. Suppose that the two streams are combined into one project, called C. What is the IRR 26. of Project C? c. What is the correct IRR rule for Project C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts